The 2024 budget cycle was my fourth budget and the most challenging negotiation I've dealt with since taking office in 2021. We entered this year with a nearly $2 Billion Medicaid budget hole, which results in an Executive budget that slashed everything from school aid to road and bridge funding. While we did not get everything we wanted from this budget (far from it, in fact), we did restore nearly all of those cuts and successfully negotiated increases to schools, upstate transit, Medicaid and Early Intervention, among other programs.

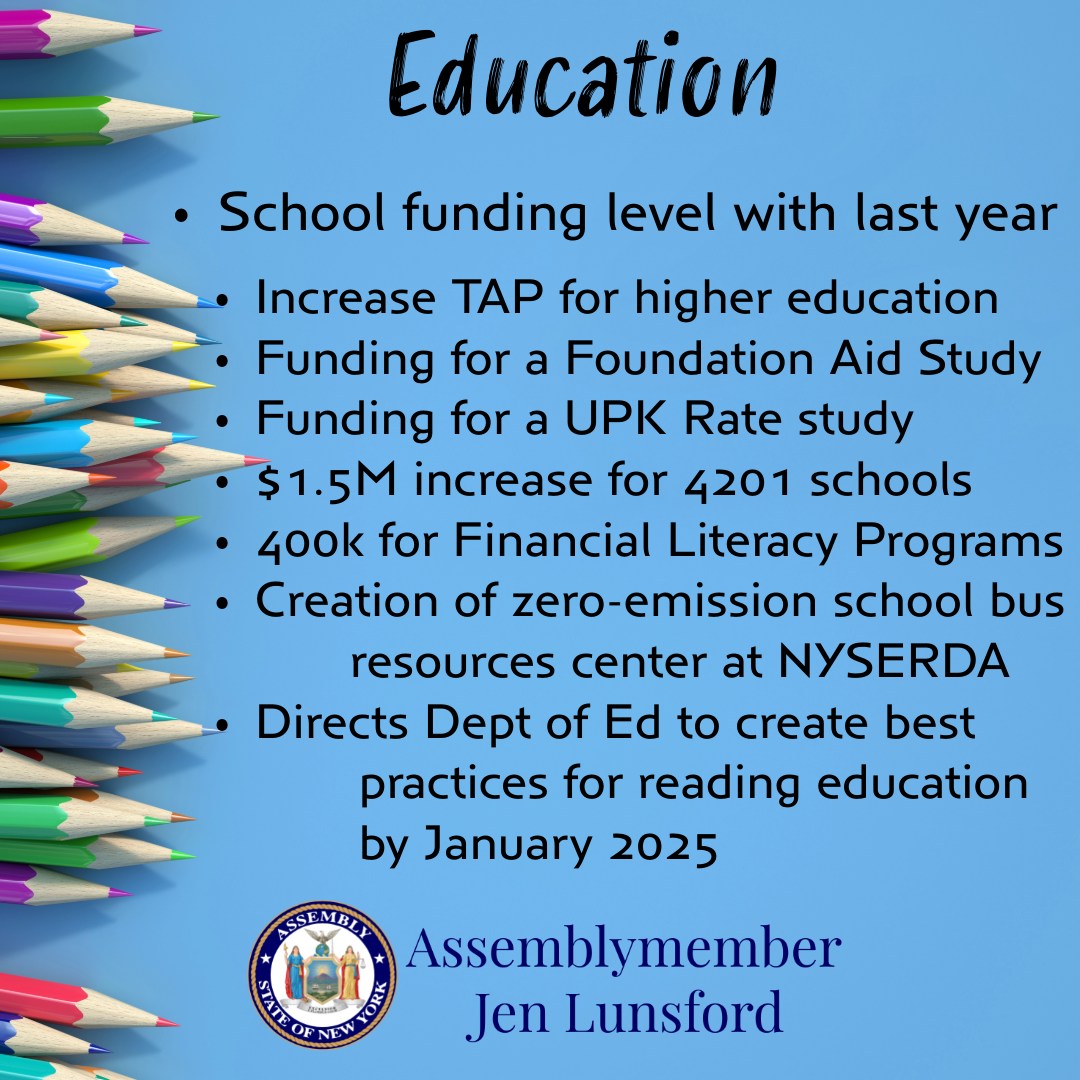

In education, we held on to our existing school aid formula for another year and were able to secure more than $37 Million in additional aid for Monroe County-based school districts. While we were not able to increase the rate for universal pre-k, we were able to fund a study on those rates which will hopefully help us fight harder for those increases next year. We also increased funding for TAP (the Tuition Assistance Program) for higher education students, which will help more people access college degrees and certificate programs. We provided $400k for financial literacy programs and directed the State Education Department to create best practices for reading education consistent with the science of reading. We also increased library construction aid for a total of $44 Million.

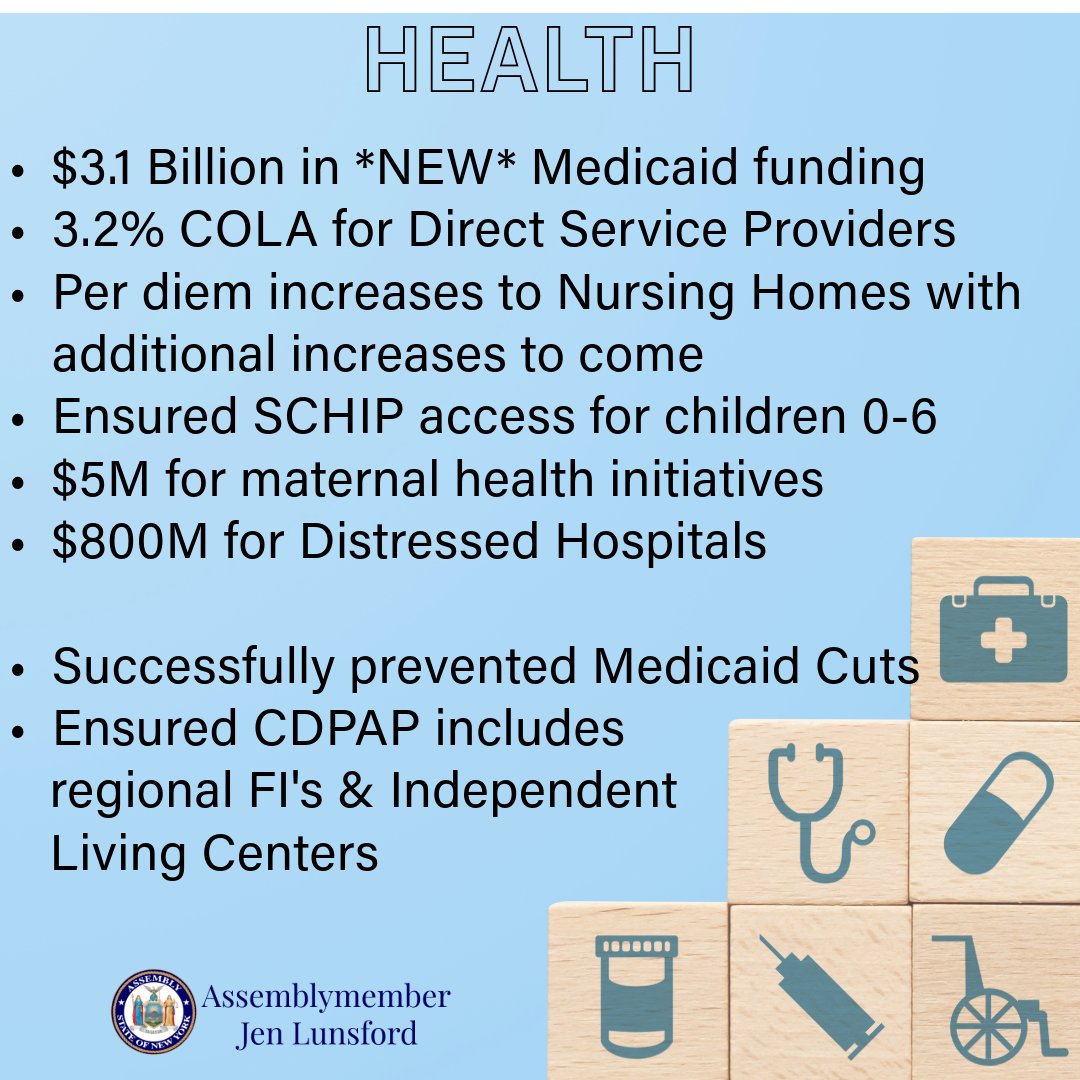

In healthcare, we passed language that will allow the state to pursue a waiver from the federal government that will provide an additional $3.1 Billion in Medicaid funding. This funding, once secured, will help us make much-needed rate increases and other expansions to hospitals, nursing homes and other congregate care settings to serve more New Yorkers. We were also able to secure the first-rate increase for Early Intervention funding since the mid-1990s! While it wasn't as much as we were hoping for, it is a great step forward and gives us a leg up when negotiating next year from the newly realized Medicaid funding. Our nursing homes will see a per diem increase, but not nearly as much as they need. We fought extremely hard to secure the necessary rate increases, and I am optimistic that this new Medicaid funding will be made available to nursing homes later this year, but that is a tough pill to swallow when these facilities have been on the brink of financial disaster for years already. I am also disappointed that the very popular emergency medical services (EMS) bills we were hoping to pass in the budget ultimately fell out. We are going to continue to fight for those during the last month of session and hopefully we will be able to pass at least part of that package. While much of this is a disappointment, there are still many bright spots, including the elimination of co-pays for life-saving insulin.

In public protection, we gave law enforcement the authority to padlock illegal cannabis shops and seize illegal inventory. Illegal cannabis shops are smoke shops, corner stores, and mobile storefronts that are selling marijuana without a license. We can't tell if their products are tested, regulated, or properly labeled, which poses a threat to our community. And they are eating into the burgeoning legal cannabis market throughout the state. Among several other changes we made in this area, we also allowed the state to revoke alcohol, tobacco, or lottery licenses from businesses that are found to also sell illegal cannabis. We hope this aggressive approach will help us get a handle on these problem shops.

We also took aim at organized retail theft by funding a state-wide police task force to provide targeted enforcement in problem areas, similar to the way in which we targeted gun violence in our community in partnership with ATF. Thanks to those efforts, we have reduced gun violence in the City of Rochester by a third, and we hope to do even more for retail theft. We also allowed prosecutors to combine the value of stolen goods across multiple incidents by the same person in order to charge repeat offenders with higher level crimes. And we provided a tax credit to retail businesses for the cost of theft prevention technology and personnel.

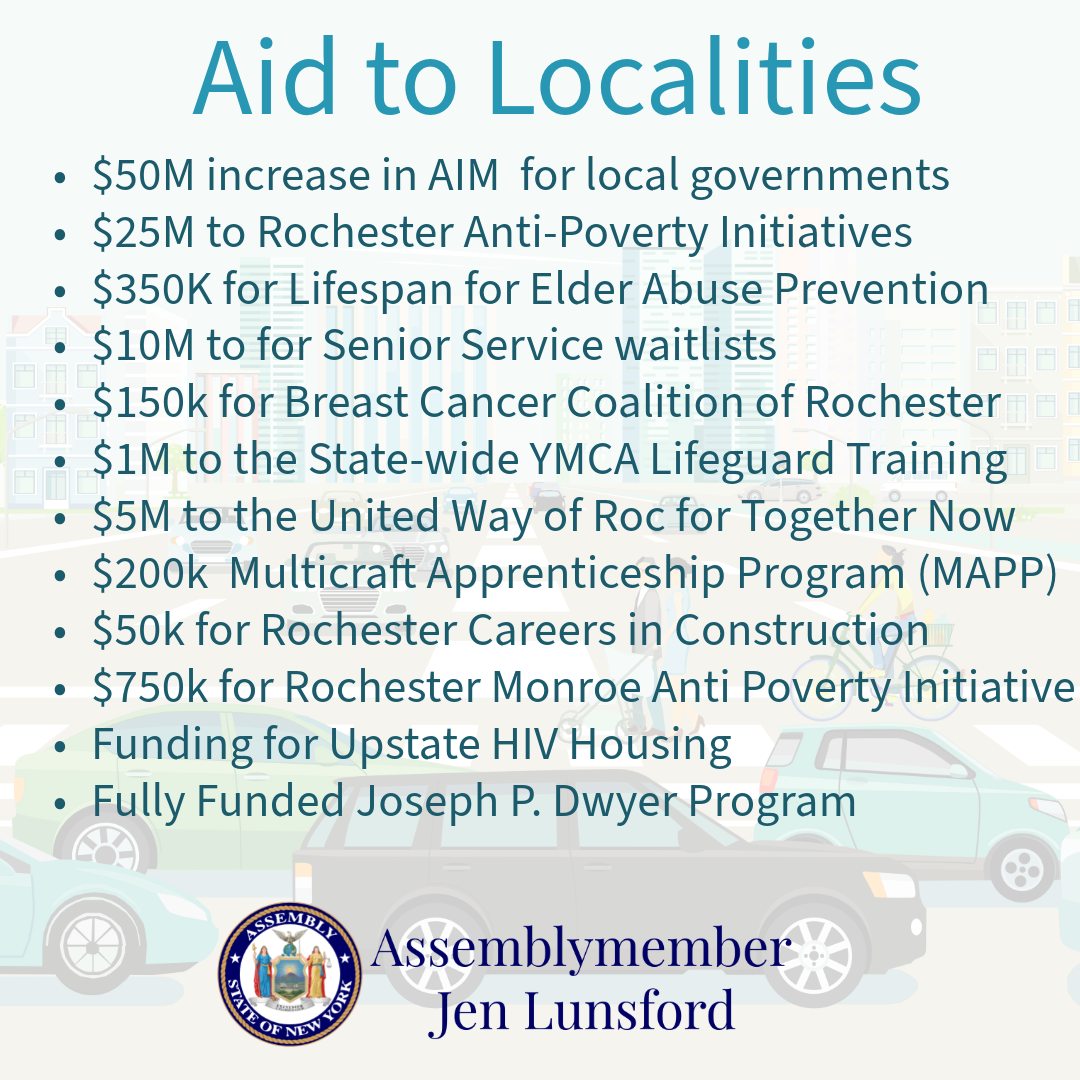

In other budget-related news, we restored funding to the Clean Water Infrastructure Act to help fund the replacement of lead service lines in our communities. We provide a $350 Million child tax credit to families on a sliding scale, as well as a state tax exemption for the purchase of energy storage products. We made some important changes to the Tier 6 pension plan that will help us recruit and retain more state workers. And we increased funding for upstate public transportation!

With every budget we must take the good with the bad, and there are some big bads in the budget, including the drastic cuts to the number of fiscal intermediaries under the CDPAP program. We were able to fight for subcontractors that allow for regions FI's, in addition to 11 independent living centers, but this is very likely to be a rocky transition. We will do everything we can to help make this as painless as possible for those who rely on this program.

Please see below for some informational graphics with fiscals specified. If you have specific questions about contents of the budget, do not hesitate to reach out to my office!