Assemblymember Rivera Calls for Major IDA Reform, Denounces School Tax Abatements for Amazon Warehouse in Hamburg, NY

Vacant Amazon warehouse project withholds almost $1.6 million in school funding from Frontier students over 10 years

Legislation would restrict the formation of new industrial development agencies in Erie County and limit the authority of town IDAs in Erie County to exempt school taxes

Hamburg, NY – Assemblymember Jon D. Rivera was joined today by the Cornell School of Industrial and Labor Relations (ILR), local elected officials, local labor leaders and members of Hamburg’s small business community to push legislation which would restrict the formation of new industrial development agencies (IDAs) in Erie County and limit the authority of town IDAs within Erie County to exempt certain taxes, e.g. for school districts.

The bill – A01551 – would allow only the Erie County Industrial Development Agency (ECIDA) to exempt state and county taxes, without prior approval. Further, this bill would require any town IDA within Erie County to seek approval if they wish to exempt any taxes other than the individual town’s property taxes.

Currently, Erie County has five town IDAs located in Amherst, Clarence, Concord, Hamburg, and Lancaster, in addition to the Erie County IDA. The ECIDA has power and authority to act on a countywide basis while the town IDAs can only act on projects within the boundaries of their town. This leads to competition between the town IDAs in attempting to lure businesses to their municipalities.

The taxes generally waived by these town IDAs consist of state and county taxes, as well as the taxes of school districts. This results in the town IDAs competing to exempt taxes from the same general pool of tax revenue.

The renewed push for this important legislation follows a recent report from Cornell ILR detailing how bad the deal is for Hamburg taxpayers. The $6.85 million incentive package was granted by the Hamburg IDA in February 2021, to Bayview Road Associates, LLC for the development of a 181,500 square-foot Amazon warehouse and delivery station on roughly 58 acres at the corner of Lakeshore Road and Bayview Road in Hamburg, NY.

The incentive package is entering its second year (2023) under the executed agreement, yet the site remains vacant with no jobs created post-construction. Under the agreement between the Hamburg IDA and Amazon, 2022 marked the first year of the Payment In Lieu of Taxes (PILOT) incentive program that allows Amazon to pay only a fraction of the county, town, and school taxes associated with the Bayview Road/Lakeshore Road parcel.

At the time the incentive package was being developed, the Cornell ILR Buffalo Co-Lab issued a factsheet revealing that:

- Only 5% of jobs expected to be created at the facility would pay above local median wages for the industry.

- The average Hamburg resident would pay more in school taxes per year than Amazon, one of the largest companies in the world.

- All but a handful of workers at the facility would struggle to afford housing in Hamburg.

- The proposed incentive package would shortchange the Frontier School District by roughly $1.6 million over the ten-year lifespan of the deal.

In the PILOT application, the Hamburg IDA estimated that Amazon would pay just $16,588.03 in school taxes for 2022. Were it not for the deal cut by the IDA, Amazon would be paying an anticipated $165,880.30.1

According to the report from Cornell ILR, in 2022, Amazon paid $15,442.73 in school taxes toward the Frontier Central School District – more than $157,500 less than what Frontier schools would have received if there were no active incentives on the property.

The structure of the PILOT agreement also suggests that Frontier Central Schools, Erie County, and the Town of Hamburg will forgo at least $2.2 million in tax revenues from the property over the ten-year period of the agreement.2

The Hamburg IDA further estimates that Amazon saved $253,200 in mortgage recording fees with the county. The tech giant also pocketed $1,767,500 in what would have been sales tax revenue (under the terms of the deal, Amazon was not charged sales tax on purchases related to the construction of the new delivery and warehouse facility).

This lost revenue most egregiously affects the Frontier Central School District, which would have been able to utilize those funds toward staff hires, facilities upgrades and maintenance, or educational and technology supplies. At a time in which school and municipal budgets are stretched to their limit, these important revenues should not be sacrificed in favor of a company aiming to create low-wage jobs with minimal benefits.

Most school districts rely primarily on property tax revenue and state aid to fund their budgets. Statewide, school districts lost out on $1.8 billion in 2021 due to tax abatements granted by their local IDA and other economic development programs, according to a February study by Good Jobs First, a subsidy watchdog organization.3

Greg LeRoy, executive director of Good Jobs First, pointed to studies that show 75-90 percent of jobs created via tax breaks would have happened without subsidies. Leroy has also previously noted that Amazon decides where to place warehouses based on logistics more than subsidies. As such, tax breaks are just a bonus for the tech giant. Amazon, for example, previously built two other warehouses in Erie County – in Tonawanda and Lancaster – and did not seek tax breaks.

Local small businesses also criticize these lavish tax subsidies as unnecessary. According to an April 2023 CNN article, Amazon posted a $3.2 billion profit for the first quarter of the year. These tax breaks are icing on the cake for a company known to extort and extract from the communities in which they set up shop.4

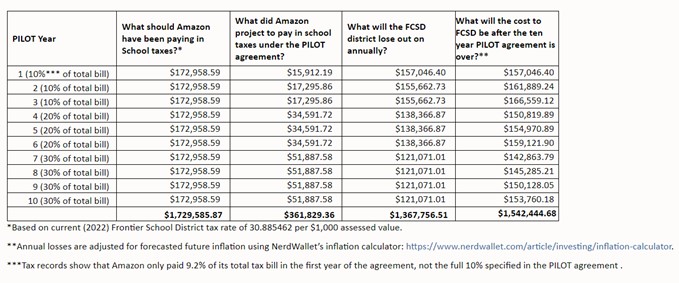

The following table showcases how tax incentives granted by the Hamburg IDA to Amazon withholds crucial funding from the Frontier Central School District over the course of the 10-year PILOT agreement:

In the most recent year, under the PILOT, Amazon paid just $2.84 per $1,000 assessed value. Comparatively, for a home valued at $220,000 — the average market valuation of a single-family residential home in Hamburg — an average homeowner in Hamburg who receives a basic STAR credit pays about $8.33 per $1,000 of assessed property value in school taxes.

In other words, on a per-$1,000-in assessed-value basis, the average homeowner paid almost three times the school taxes that Amazon paid last year. Thus, Amazon’s tax break is much more lucrative than the tax break (STAR credit) afforded to homeowners.

Assemblymember Rivera’s legislation will mitigate the wasteful, inefficient subsidies granted by Town IDAs to large corporations, and will encourage stronger negotiations on behalf of the public to secure more tax revenue, and better paying jobs.

Assemblymember Jon D. Rivera said, “The kind of tax breaks that the Hamburg IDA gifted to Amazon won’t bring meaningful public benefit, nor will they enact any significant economic growth within our community. Projects such as these, which would be constructed even without subsidies and were granted for a company that brought in $514 billion in sales revenue in 2022, should not be considered viable options for government funding. We must prioritize dollars and attention on local business owners and entrepreneurs who are the backbone of our economy. My legislation will go a long way in minimizing the harmful impacts of IDAs redirecting vital funding sources away from our community.

Town of Hamburg Supervisor Randy Hoak said, “I was not on the Town Board when the Town brokered this deal with Amazon. As a citizen, I didn’t think it was good deal. As the current Town Supervisor, I will work with Amazon for a positive outcome, however the repeated delays have me very worried that Amazon may not keep their end of the deal. We need to be better stewards of the taxpayer’s dollars.”

Rusty Weaver, Director of Research at Cornell ILR’s Buffalo Co-Lab said, “Public dollars need to be invested, not given away – and especially not given away to global corporations that, frankly, don’t need our taxpayers’ money. If, as a region and a society, we are going to remain committed to subsidizing economic development activity, then we need to be more discerning in how we go about doing it. If we’re going to invest our public dollars, then our investments need to be High Road investments that yield broad-based, community returns. I thank Assemblymember Rivera and his co-sponsors for proposing legislation that will begin building bridges to this sort of High Road economic development, while closing off Low Road paths that continue to funnel our communities’ valuable public resources to mega-corporations that collect record profits at the topic while paying poverty wages at the bottom.”

Tom Hoelzl of Hoelzl Tire & Service said, “As a small business owner who runs a business that has been operating for 65 years, I feel that IDAs unfairly interfere with taxpayer-share responsibility. No one likes paying taxes. We know however, that things like roads, schools, and services must be funded somehow. Local taxpayers should rightfully be angry when a large corporation is given a free ride.”

Citations

1 www.hamburgida.com/application/files/8916/6056/5046/ProjectUpdate_Bayview_Road_Associates.pdf

2 www.hamburgida.com/download_file/3129/1207 - Page 24

3 https://www.investigativepost.org/2023/02/08/report-tax-breaks-costing-schools-big-money/

4 https://www.cnn.com/2023/04/27/tech/amazon-earnings/index.html