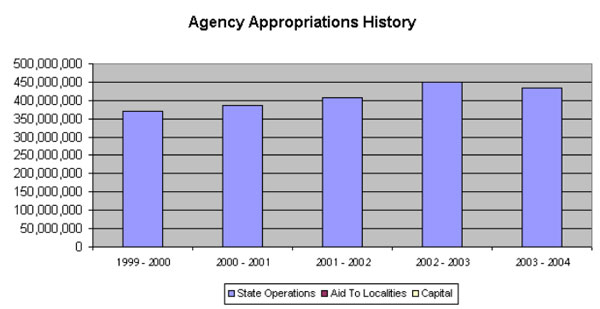

* 1999-00 through 2001-02 reflect enacted appropriations.

* 1999-00 through 2001-02 reflect enacted appropriations.

* 2002-03 and 2003-04 reflect Executive recommended appropriations.

| 2003 Yellow Book | |||||

| Backward | Forward | Cover | Overview | Agency Summaries | Agency Details |

|

Department of Taxation and Finance (Summary) View Details |

|

|

|||||

|

Adjusted Appropriation 2002-03 |

Executive Request 2003-04 |

Change |

Percent Change |

||

|

|

|||||

| AGENCY SUMMARY | |||||

|

|

|||||

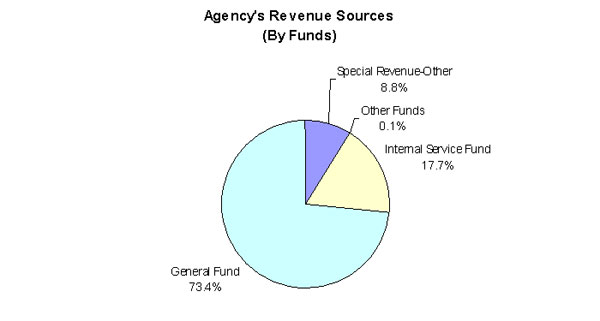

| General Fund | 332,386,500 | 318,327,000 | (14,059,500) | -4.2% | |

| Special Revenue-Federal | 572,000 | 582,000 | 10,000 | 1.7% | |

| Special Revenue-Other | 40,644,000 | 38,024,000 | (2,620,000) | -6.4% | |

| Internal Service Fund | 76,185,400 | 76,905,000 | 719,600 | 0.9% | |

|

|

|||||

| Total for AGENCY SUMMARY: | 449,787,900 | 433,838,000 | (15,949,900) | -3.5% | |

|

|

|

|

|||

|

ALL FUNDS PERSONNEL BUDGETED FILL LEVELS |

|||

| Fund |

Current 2002-03 |

Requested 2003-04 |

Change |

|

|

|||

| General Fund: | 4,624 | 4,498 | (126) |

| All Other Funds: | 424 | 424 | 0 |

|

|

|||

| TOTAL: | 5,048 | 4,922 | (126) |

|

|

|

Budget Highlights |

|

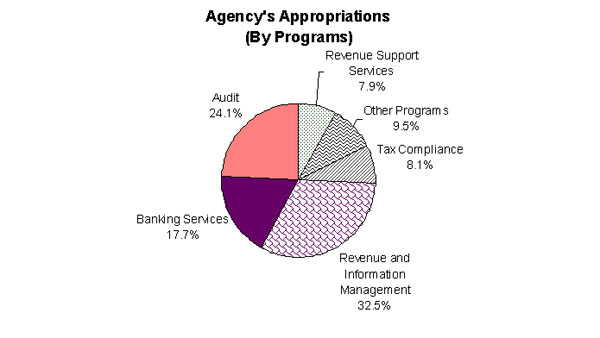

The Department of Taxation and Finance is responsible for the State's taxation administration, along with the administration of related local taxes. The Department is included in the Transportation, Economic Development, and Environmental Conservation appropriation bill. State Operations The Executive recommends all funds appropriations totaling $433,838,000, a decrease of $15,949,900 or 3.5 percent from State Fiscal Year (SFY) 2002-03 levels. This amount includes General Fund appropriations of $318,327,000, a decrease of $14,059,500 or 4.2 percent from SFY 2002-03. The Executive General Fund recommendation includes the following notable changes:

The Executive recommends a decrease of $2,766,000 in the Special Revenue Funds - Other, New York City Assessment Account. Revenues are deposited into this account to offset the State's cost of administering the New York City Personal Income Tax. The amount assessed to the city is based on the total level of State General Fund tax collections. |

|

|

|||||

| Backward | Forward | Cover | Overview | Agency Summaries | Agency Details |

|

New York State Assembly [Welcome] [Reports] |