New York State Assembly

|

Sheldon Silver Speaker of the Assembly |

Herman D. Farrell, Jr. Chairman of the Ways and Means Committee |

While the loss of jobs immediately after September 11th was large, in recent months that number has shrunk. There are indications of revival in hotel revenues in New York City. The decline in residential rents appears to have subsided. A good number of the jobs that moved out of New York City have returned. Continued weakness in office space market, and in the air transport industry, as well as rising insurance rates in the city, are the concerns.

New York State Employment

- 127,200 fewer jobs in the fourth quarter of 2001 than the fourth quarter of 2000.

- 136,800 fewer jobs in the first quarter of 2002 than the first quarter of 2001.

- 92.7 percent of the jobs lost in the fourth quarter of 2001 were in New York City.

Sources: U.S. Bureau of Statistics

Sources: U.S. Bureau of Statistics- 57,800 jobs lost in manufacturing (28.4 percent in NYC).

- 20,500 jobs lost in Trade (54.6 percent in NYC).

- 30,900 jobs lost in FIRE (104.1 percent in NYC*).

- 28,100 jobs lost in Services (158.7 percent in NYC*).

(*Shares greater than 100 percent indicate a net gain of jobs outside of NYC.)

Below 14th Street: Economic Summary (2000)

- Wages: $47.1 billion (14.9 percent of State).

- Employment: 502,000 (7.3 percent of State).

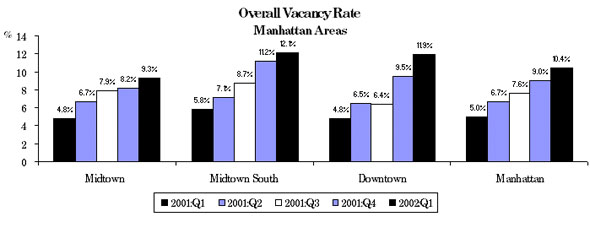

- The office vacancy rate continues to rise in Manhattan and major sub-markets, as it did in 2001.

Source: Cushman and Wakefield, April 2002

- The office vacancy rate downtown increased faster than either midtown or midtown

south from the third quarter of 2001 until the first quarter of 2002.

- The office vacancy rate downtown nearly doubled since the third quarter of 2001,

increasing by 5.5 percentage points. This compares to a 3.4 percentage point increase for

midtown south and only a 1.4 percentage point increase for midtown.

- The attack of September 11th destroyed or damaged 25.8 million square feet or 23.9

percent of downtown office space.

- Only 6.0 million square feet of damaged space is now back on the market.

Manhattan Residential Real Estate (Insignia Douglas Elliman, First Quarter 2002)

- The inventory of residential units for sale contracted 31.7 percent in the first quarter

of 2002 over the prior quarter.

- The average residential unit sale price rose one percent in the first quarter of 2002

over the prior quarter.

- The average residential unit sale price in the first quarter of 2002 is still 10.1

percent below its level in the first quarter of 2001.

- Residential rents for July to December 2001 were below their levels for the same period

in 2000.

Downtown: 11.0 percent lower

Manhattan: 7.3 percent lower

Midtown: 7.1 percent lower

Chinatown (Asian American Federation of New York, April 2002)

In Chinatown during the three months after September 11th:

- 40 out of 246 apparel factories closed.

- Restaurant revenue fell 30 to 70 percent.

- Retail revenue fell 55 percent.

- 237 of the 4,000 businesses received business loans.

Tourism

- In 2001 New York City had 32 million visitors, down 15 percent from 37.4 million in

2000.

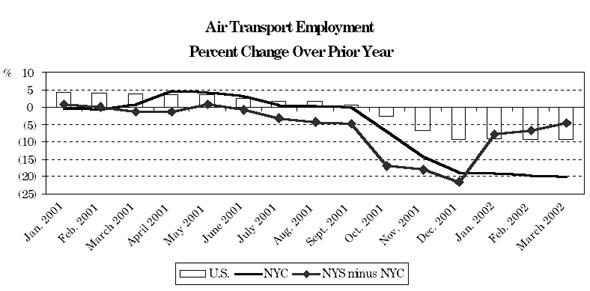

- Air transport employment dropped 20 percent from March 2001 to March 2002 in New

York City.

- Air transport employment in the State outside of New York City has declined but

slower than the nation as a whole.

- New York City hotel revenues have dropped a greater degree over the prior year than

the United States as a whole.

- However, the drop in hotel revenues is much less than was experienced just after September 11th.

Source: U.S. Bureau of Labor Statistics

Source: U.S. Bureau of Labor Statistics

- Of the 19,000 jobs that relocated out of the New York City from large establishments, 11,400 are expected to return in 2002.

Source: Smith Travel Research; NYS Assembly Ways and Means Committee

staff estimates

Source: Smith Travel Research; NYS Assembly Ways and Means Committee

staff estimates

- Business insurance rates increased 20 to 40 percent.

- Property insurance rates-median increase 50 percent, range 20 to 330 percent.

- Casualty insurance rates increased 15 to 100 percent.

Securities Industry Profits (Securities Industry Association, April 2002)

- 2001: $10.4 billion (decline of 50.5 percent).

- 2002 forecast: $13.2 billion (growth of 27.0 percent).

- U.S. Small Business Administration has approved more than $257.9 million in

low-interest loans to small businesses in New York City.

- 30 percent of the loan requests have been approved.

- 62 percent of stores and restaurants surveyed characterize their losses as severe.