| New York State |

March 2003

|

|

|

Revenue Report March 2003 |

|

|

|

| Sheldon Silver, Speaker | Herman D. Farrell, Jr., Chairman |

New York State Assembly Ways and Means Committee Staff |

|

ASSEMBLY WAYS AND MEANS COMMITTEE

HERMAN D. FARRELL, JR. MAJORITY MEMBERS |

|

|

|

|

|

JOSEPH R. LENTOL ALEXANDER B. GRANNIS IVAN C. LAFAYETTE ROBIN L. SCHIMMINGER CLARENCE NORMAN, JR. WILLIAM L. PARMENT RONALD J. CANESTRARI THOMAS P. DINAPOLI DAVID F. GANTT HELENE E. WEINSTEIN RONALD C. TOCCI DEBORAH GLICK |

CATHERINE T. NOLAN BRIAN M. MCLAUGHLIN JAMES GARY PRETLOW ROGER L. GREEN N. NICK PERRY WILLIAM COLTON RUBEN DIAZ, JR. ADRIANO ESPAILLAT AURELIA GREENE ROANN DESTITO SAM HOYT JACK MCENENY |

|

NEW YORK STATE REVENUE REPORT 2002-03 & 2003-04 |

|

|

|

|

|

March 2003

Sheldon Silver

Herman D. Farrell, Jr. |

|

|

Prepared by the

Dean A. Fuleihan |

|

|

|

|

|

|

|

|

Roman B. Hedges Deputy Secretary |

Kristin M. Proud Deputy Secretary |

|

|

|

|

Edward M. Cupoli Chief Economist/Director of Research |

Steven A. Pleydle Director of Tax & Fiscal Studies |

|

|

|

|

Thomas R. Andriola Associate Deputy Director for Fiscal Studies |

Scott V. Palladino Deputy Director of Fiscal Studies |

|

March, 2003 Dear Colleagues: I am pleased to provide you with the NYS Assembly Ways and Means Committee Revenue Report for State Fiscal Year (SFY) 2002-03 and 2003-04. This report is part of our commitment to presenting clear and accurate information to the public. It provides an overview of the national and State economies, as well as an analysis of the Committee Staff revenue forecast for SFY 2002-03 and 2003-04. The Committee Staff projects that tax receipts will total $40.849 billion in SFY 2002-03, which represents a decline of $3.465 billion, or 7.8 percent, over SFY 2001-02. The Committee Staff estimate is $189 million lower than the Executive's estimate for SFY 2002-03. This difference is largely attributable to differences in economic projections and how this translates into receipts. The Committee Staff projects that tax receipts will total $41.185 billion in SFY 2003-04, an increase of $336 million, or 0.8 percent, over SFY 2002-03. The Committee Staff forecast is $252 million higher than the Executive's forecast for SFY 2003-04. The Committee Staff projections are reviewed by an independent panel of professional economists drawn from major financial corporations, prestigious universities, and private forecasters from across the State. Assembly Speaker Sheldon Silver and I would like to express our appreciation to all of the members of our Board of Economic Advisors. Their dedication and expert judgement have been invaluable in helping the Ways and Means Committee Staff refine and improve this forecast. They have served to make the work of the staff the best in the State. Of course, they are not responsible for either the numbers or any of the views expressed in this document. I wish to acknowledge the fine work done by the talented Ways and Means Committee Staff. Their forecasts are integral to the budget process. The Speaker and I look forward to working with each of you to achieve a fair budget for all New Yorkers.

Sincerely, |

|

State Receipts Overview The main part of the receipts discussion and analysis will focus on total tax collections rather than on General Fund and Lottery receipts, which was done in the past. In recent years, a significant portion of tax revenue has been shifted out of the General Fund and redirected to dedicated funds. While a large portion of this revenue is ultimately returned to the General Fund in the form of transfers, the discussion of total tax collections provides a more accurate picture of the relationship between tax revenues and the underlying economic data that drive revenue growth. General Fund and Lottery receipts, however, will still be discussed in a separate section of the report. SFY 2002-03

SFY 2003-04

Economic Overview

|

|

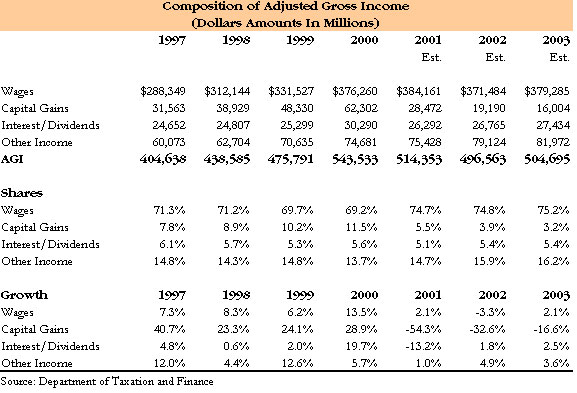

The Committee Staff projects that tax collections will total $40.849 billion in State Fiscal Year (SFY) 2002-03, representing a decline of $3.465 billion, or 7.8 percent, over SFY 2001-02. This estimate is $189 million lower than that of the Executive. Through January 2003, total tax collections have declined by $4.803 billion, or 12.0 percent, over the same period last fiscal year. Much of the decline in tax collections is the result of the April 2002 "settlement" on Tax Year 2001 income tax liability. However, current year tax collections have also declined due to continued weakness in the economy. In addition to these factors, part of the year-to-date decline in tax receipts reflects a deposit of only $1.677 billion from the Refund Reserve account at the beginning of the year versus the $3.517 billion transferred in April 2001. The Committee Staff estimate for SFY 2002-03 also reflects approximately $664 million in incremental tax cuts, as well as approximately $339 million in non-recurring tax receipts. The Committee Staff forecasts that tax receipts will total $41.185 billion in SFY 2003-04, representing an increase of $336 million, or 0.8 percent, over SFY 2002-03. Although a mild rebound in the economy is expected in 2003, the loss of non-recurring tax actions and incremental tax cuts of approximately $518 million will serve to dampen tax collections for SFY 2003-04. The Executive Budget contains approximately $733 million in newly proposed taxes will mitigate this decline to some degree. The Committee Staff forecast is $252 million higher than that of the Executive. Over the two-year forecast period, the Committee Staff forecast for tax collections is $63 million higher than that of the Executive. The Committee Staff estimates that tax collections in SFY 2002-03 will be about $2.6 billion less than estimated in the Executive's Mid-Year Financial Plan Update, which was released October 30, 2002, and reflected no change from the Enacted Budget Report released in May 2002. Most of this reduction is in the Personal Income Tax, which is expected to yield approximately $2.1 billion less for the fiscal year than originally estimated in the Enacted Budget Report. The Committee Staff estimate for Business Tax collections reflects a $499 million reduction, while receipts for the other tax categories are projected to end the year approximately $32 million higher than budgeted for in the Financial Plan Update. Growth in the nation's economy throughout much of the 1990s led to unprecedented growth in New York State tax receipts during that time period. As shown in Figure 1, tax collections, adjusted for withdrawals from and deposits to the Refund Reserve account, grew on average by 7.1 percent for each of the three fiscal years beginning in SFY 1998-99. Since then, the recession of 2001 has caused tax receipts to decline for two years in a row. Tax collections are expected to rebound in SFY 2003-04, but are only expected to increase by 4.1 percent over SFY 2002-03. Strong growth in technology, productivity and the equity markets led to high growth in wages and variable income in the latter part of the 1990s. In fact, much of the strong receipts growth was due to stock options, capital gains and bonuses that accrued to high level executives because corporate profits were rising sharply. These economic variables tend to generate proportionately higher levels of tax revenues because they tend to affect wealthier taxpayers that pay under a higher income tax bracket. For example, thirty percent of tax liability in Tax Year 2000 came from taxpayers making more than $1 million that year, yet taxpayers in this income range represent less than one-half of one percent of all tax filers. Those same taxpayers collected two-thirds of all capital gains for the year, or roughly $41 billion out of slightly more than $62 billion. Figure 2 illustrates the actual volatility in capital gains growth over a ten-year period, as well as estimates for 2002 and 2003. Following the burst of the stock market bubble, capital gains realizations declined substantially. Consequently, capital gains in Tax Year 2001 are estimated to have fallen by 54.3 percent to $28.5 billion, the lowest level since 1996, after an increase of 28.9 percent in 2000. Capital gains are estimated to have declined by an additional 32.6 percent in calendar year 2002, to a level of approximately $19.2 billion, almost 70 percent below the $62.3 billion reported in 2000. Such a large swing in capital gains from one year to the next can cause a dramatic impact on the amount of tax State revenues collected. This impact can easily be seen in quarterly estimated payment collections. For example, quarterly estimated payments increased by $953 million, or 20.4 percent, in SFY 2000-01, followed by a decline of $936 million, or 16.7 percent, the following fiscal year. In SFY 2002-03, quarterly estimated payments are expected to fall by an additional $857 million, or 18.3 percent. A more dramatic illustration is in the April "settlement" numbers, which can be seen in Figure 3.1 In SFY 2001-02, filing extensions and final payments increased by 36.6 percent and 14.7 percent respectively, and refund payments declined by 11.3 percent.2 In the following fiscal year, filing extensions and final payments declined by 39.3 percent and 32.8 percent respectively, while refund payments increased by 31.7 percent. All told, the decline in the "settlement" components of the Personal Income Tax resulted in a revenue loss of almost $1.6 billion from SFY 2001-02.  Figure 3

Figure 3

1 The April "settlement" consists of Personal Income Tax collections resulting final payments, filing extensions, and refunds paid based on the traditional April 15th filing deadline on prior year tax liability. 2 Refund "settlement" numbers are based on April and May combined due to additional processing time requirements. |

|

The State's current fiscal crisis is directly related to inaction on the part of the Executive to recognize the precarious nature of the State's receipts and take corrective action upon the release of his Mid-Year Financial Plan Update on October 30, 2002. The Executive's Enacted Budget Report, released on May 22, 2002, reflected certain revenue revisions from his original Budget proposal in January 2002. The revisions reflected the disappointing April "settlement" noted earlier, as well as expected revenues resulting from legislation enacted as part of the Budget. Over time revenues continued their downward trend as the economy remained weaker than had been anticipated. By the end of September 2002, tax revenues had declined by $1.9 billion, or 8.8 percent, over the same period in SFY 2001-02. Yet, the Executive's Enacted Budget Report continued to expect tax revenue decline of only $271 million, or 0.6 percent for the entire fiscal year. This meant that in order for the tax revenues to finish the year as projected, they would have to grow by $1.6 billion, or 7.6 percent, during the second half of the fiscal year. More specifically, Personal Income Tax collections would have to grow by 10.4 percent, and Corporate Franchise Tax collections would have to grow by more than 50 percent just to reach the numbers reflected in the Enacted Budget Report. Based on the available revenue data and continued weakness in the economy at the time, a reasonable analysis would have resulted in a downward revision in the Executive's Mid-Year Financial Plan. However, this was not the case. In fact, the Executive did not change a single revenue or spending estimate for SFY 2002-03. In conclusion, the Mid-Year Financial Plan Update significantly overstated receipts in light of what was known then and what has happened since.

Personal Income Tax Collection Remain Sluggish The Committee Staff estimates that Personal Income Tax receipts will total $22.584 billion in SFY 2002-03, representing a decline of $2.990 billion, or 11.7 percent over SFY 2001-02. This estimate is $171 million lower than that of the Executive. However, funds from the Refund Reserve account will be used to boost Personal Income Tax receipts by $1.250 billion, increasing the total to $23.834 billion for the fiscal year. This represents a decline of $3.580 billion, or 13.1 percent, over SFY 2001-02. This additional decline is due to the fact that funds from the Refund Reserve account used to boost SFY 2001-02 Personal Income Tax revenues totaled $1.840 billion. Through January 2003, Personal Income Tax receipts have declined by $2.951 billion, or 13.0 percent over the same period in SFY 2001-02. Again, much of this decline is attributable to the April "settlement" of Tax Year 2001 liability. Filing extensions and final payments have declined by 38.6 percent and 30.5 percent respectively, and refund payments have increased by 28.4 percent year-to-date. However, weakness in both quarterly estimated payments and withholding collections is also a contributing factor to the overall decline in Personal Income Tax receipts. The estimated decline in Personal Income Tax receipts also includes approximately $175 million in incremental tax cuts resulting from the continued phase-in of the enhanced Earned Income Tax Credit (EITC), the College Tuition Deduction/Credit, and the Marriage Penalty reduction. These estimates also include an exemption worth $25 million granted to the families of the victims of the attack on the World Trade Center, an increase of $25 million for changes to the Electronic Funds Transfer (EFT) filing program and an increase of approximately $181 million for the Tax Amnesty program. General Fund Personal Income Tax collections are expected to total $16.941 billion in SFY 2002-03, representing a decline of $8.912 billion, or 34.5 percent over SFY 2001-02. This estimate is $129 million lower than that of the Executive. This estimate includes funds transferred from the Refund Reserve account totaling $1.250 billion, and reflects dedicated transfers of $2.667 billion to fund the School Tax Relief (STAR) Program and of $4.226 billion deposited into the recently created Revenue Bond Tax Fund (RBTF). 3 Because deposits into the RBTF began in SFY 2002-03, General Fund Personal Income Tax collections will be significantly lower than in past years.

3 As of May 2002, 25 percent of Personal Income Tax receipts, excluding reserve transactions, are deposited into the Revenue Bond Tax Fund (RBTF), which is used for debt service. |

|

SFY 2003-04 The Committee Staff forecasts Personal Income Tax collections to total $23.220 billion in SFY 2003-04, representing an increase of $636 million, or 2.8 percent, over SFY 2002-03. However, funds from the Refund Reserve account will not be available to boost Personal Income Tax receipts in SFY 2003-04. In fact, $41 million in Personal Income Tax receipts will be moved back to the Refund Reserve account over the course of the fiscal year, reducing total Personal Income Tax collections to $23.179 billion, an actual decline of 2.7 percent. This forecast is $120 million higher than that of the Executive. In SFY 2003-04, Personal Income Tax receipts will be dampened by an estimated $195 million in incremental tax cuts, again resulting from the continued phase-in of the enhanced Earned Income Tax Credit (EITC), the College Tuition Deduction/Credit, and the Marriage Penalty reduction. In addition, the forecast includes $89 million resulting from legislation proposed by the Executive to double the filing fees required by certain Limited Liability Companies (LLCs) and Limited Liability Partnerships (LLPs) and to require certain organizations to pay estimated tax to New York on behalf of non-resident members. General Fund Personal Income Tax collections are forecast to total $15.344 billion in SFY 2003-04, representing a decline of $1.597 billion, or 9.4 percent over SFY 2001-02. This forecast includes funds transferred to the Refund Reserve account of $41 million, and estimated transfers to STAR of $2.707 billion and to RBTF of $5.128 billion. This forecast is $90 million higher than that of the Executive. Personal Income Tax Components There are several components that make up the Personal Income Tax, ranging from withholding, which is forwarded by employers to the Tax Department on behalf of their employees, to payments or refunds made by or to individuals upon settling up tax liability by the traditional April 15 deadline. All of the Personal Income Tax components are included in the tables, and some of the more important ones are also discussed below. Withholding Withholding collections currently account for almost 50 percent of all tax collections. Changes in withholding are closely tied to changes in New York wages, and tend to grow or decline at a faster rate than the corresponding growth or decline in wages. This elasticity, measured by the ratio of the percentage change in withholding to the percentage change in New York wages, tends to be even greater for variable compensation than it is for base wage compensation. This is because variable compensation, which includes bonuses and stock options, is generally earned by taxpayers in the higher income brackets that pay a higher effective tax rate on each additional dollar earned. The elasticity of withholding to wages has averaged approximately 1.2 during the most recent five fiscal years ending in SFY 2001-02. When variable compensation hit its peak in SFY 2000-01, the elasticity of withholding to wages reached almost 1.7. The Committee Staff estimates that this elasticity will to return to a level of about 1.2 for both SFY 2002-03 and SFY 2003-04, reflecting lower levels of variable compensation due to the current state of the economy. Through January 2003, withholding collections have declined by $179 million, or 1.1 percent, for the fiscal year, following a decline of 3.3 percent in SFY 2001-02. Withholding collections are expected to total $19.900 billion in SFY 2002-03, representing a decline of $361 million, or 1.8 percent. This estimate is based on collections through January 2003, coupled with an expected decline in variable wages of 19.5 percent and expected growth in base wages of 1.7 percent in the first quarter of 2003, and includes a reduction in the threshold requirement for EFT filers. This estimate is $145 million lower than that of the Executive. The Committee Staff forecasts withholding receipts to total $21.011 billion in SFY 2003-04, an increase of $1.111 billion, or 5.6 percent over SFY 2002-03. This forecast includes $89 million resulting from legislation proposed by the Executive to double the filing fees required by certain Limited Liability Companies (LLCs) and Limited Liability Partnerships (LLPs), and to require certain organizations to pay estimated tax to New York on behalf of non-resident members. Excluding this proposed legislation and certain other adjustments, withholding collections are expected to grow by 4.9 percent over SFY 2002-03. Expected wage growth of 3.9 percent in SFY 2003-04 translates to an elasticity of withholding growth to wage growth of slightly more than 1.2. This forecast is $94 million lower than that of the Executive. Installment Payments Installment payments are quarterly estimated tax payments made by taxpayers if their final tax liability is expected to be significantly higher than the amount of tax being withheld from their wages. One of the main drivers of installment payments is capital gains, which are estimated to have declined by 32.6 percent in calendar year 2002. Since 2000, taxable capital gains reported by New York taxpayers are estimated to have declined by almost 70 percent to a level of approximately $19.2 billion from a reported high of $62.3 billion in 2000. Installment payments have declined by $845 million, or 18.2 percent, through January 2003. The Committee Staff estimates that installment payments will total $3.828 billion in SFY 2002-03, representing a decline of $857 million, or 18.3 percent for the full fiscal year. This estimate is $2 million lower than that of the Executive. In SFY 2003-04, installment payments are forecast to total $3.765 billion, a decline of $63 million, or 1.6 percent. This decline in installment payments is based on an additional falloff in capital gains of 16.6 percent for calendar year 2003. This forecast is $120 million higher than that of the Executive. A significant amount of capital gains realizations come from the sale of equities that gain value over the course of time. As can be seen in Figure 6, the burst of the stock market bubble has decreased stock valuations sharply over a short period of time. Settlements In April, taxpayers must file either an extension or final return to settle up their tax liability for the prior calendar year. These returns are accompanied by a corresponding payment, if the taxpayer owes money, or by a claim for a refund, if the taxpayer has paid too much over the course of the year. As a result, the month of April is usually large in terms of Personal Income Tax collections. As stated previously, the "settlement" collected in April 2002 for liability incurred in Tax Year 2001 declined sharply compared to the prior year. Final payments, which result from the timely filing of tax returns due each April 15, have declined by $541 million, or 30.5 percent, through January 2003. The Committee Staff estimates that final payments will total $1.322 billion in SFY 2002-03. This estimate is $13 million lower than that of the Executive. In SFY 2003-04, final payments are forecast to total $1.163 billion, a decline of $159 million, or 12.0 percent. This forecast is $23 million higher than that of the Executive. Taxpayers are allowed an automatic four-month extension for final payment on tax liability from the previous calendar year. However, they are still required to accurately estimate liability and submit any corresponding payment with the extension. Generally, more than 90 percent of these extension deposits are made in April. In April 2002, extension deposits fell by $641 million, or 39.3 percent, over April 2001. The Committee Staff estimates that extension deposits will total $1.024 billion in SFY 2002-03, representing a decline of or 38.6 percent. This estimate is $1 million lower than that of the Executive. In SFY 2003-04, extension deposits are forecast to total $887 million, a decline of $137 million, or 13.4 percent. This forecast is $47 million higher than that of the Executive. Refunds are issued to taxpayers that have paid too much based on their tax liabilities. The dollar amount of refunds paid out between January and March of each year is administratively determined by the Executive. The amount paid during this three-month period over the past few years has been $960 million. Beginning in April, the rest of these refunds, known as prior year refunds, are paid to taxpayers as they are processed. Roughly two-thirds of prior year refunds are paid out in April and May of each year. The Committee Staff estimates that prior year refunds will total $2.773 billion in SFY 2002-03, representing an increase of $608 million, or 28.1 percent. This estimate is $3 million higher than that of the Executive. In SFY 2003-04, prior year refunds are forecast to total $2.793 billion, an increase of $20 million, or 0.7 percent. This forecast is $127 million lower than that of the Executive. User Taxes and Fees Shows Signs of Life SFY 2002-03 User Taxes and Fees include Sales and Compensating Use, Cigarette and Tobacco, Highway Use, Motor Fuel, Auto Rental and Alcohol Beverage Taxes, and Motor Vehicle and Alcohol Beverage Fees. For SFY 2002-03, the Committee Staff estimates that User Taxes and Fees will total $10.813 billion, an increase of 2.6 percent from SFY 2001-02. The Committee Staff estimate is $26 million higher than that of the Executive. A large part of the increase can be explained by a rebound in Sales and Use Taxes, coupled with strong collections in Motor Fuel Taxes and Motor Vehicle Fees. On a General Fund basis, User Taxes are expected to total $7.017 billion, a decline of $28 million, or 0.4 percent. Much of the decline in the General Fund is attributed to a decline in General Fund Cigarette Taxes, which have declined by $81 million in spite of the recent tax increases due to an increase in revenue dedicated to fund components of the Health Care Reform Act (HCRA). The remaining $3.7 billion of total User Tax and Fee collections are dedicated for other purposes.4

4 Excluded from this amount are Cigarette Tax collections dedicated to the Tobacco Control and Insurance Initiatives Pools established pursuant to the Health Care Reform Act. The funds in these pools are not considered part of the State Funds Budget and therefore are not included in the figures reported here. In SFY 2002-03, the total amount of dedications to these pools is estimated at $697 million. In SFY 2003-04, total dedications are forecast at $636 million. SFY 2003-04 In SFY 2003-04, User Taxes and Fees are expected to total $11.450 billion, an increase of $637 million, or 5.9 percent. Much of the growth in this category is due to Executive Article VII proposals which are expected to increase total tax collections by $412 million. This estimate is $13 million lower than that of the Executive. On a General Fund basis, collections from User Taxes and Fees are expected to generate $7.495 billion, an increase of $424 million, or 6.0 percent. Again, the increase is largely attributable to Executive proposals to increase taxes. Sales Tax The largest component of the User Taxes, the Sales Tax has been a relatively stable contributor to the State's tax collections, as shown in Figure 7. Sales Tax collections rebounded moderately in State Fiscal Year (SFY) 2002-03 from the suppressed levels of the previous year, and is expected to total $8.791 billion, an increase of $251 million, or 2.9 percent from SFY 2001-02. However, a portion of this growth is due to legislative changes enacted last year as part of the budget that increased receipts in the current fiscal year. These changes include the State Tax Amnesty Program and lowering the requirement for payment by Electronic Funds Transfer, which together provided a one-time injection of $107 million in the current fiscal year. After adjusting for these legislative actions, the growth rate for SFY 2002-03 is reduced to 1.9 percent. The Committee Staff estimate is $18 million above the Executive on an All Funds basis. Twenty-five percent of total Sales Tax collections generated from the statewide tax are dedicated to pay debt service incurred by the Local Government Assistance Corporation (LGAC). The amount dedicated to LGAC is expected to total $2.104 billion. All other Sales Tax receipts, which are estimated at $6.312 billion, are deposited into the General Fund. The growth in General Fund Sales Tax collections is also expected to be 2.9 percent. In addition to the four percent statewide Sales Tax, total collections include receipts from the 0.25 percent tax imposed in the Metropolitan Transportation Commuter District (MCTD). Revenues generated from the special MCTD portion of the tax are expected to total $375 million and are dedicated to Mass Transportation Operating Assistance Fund (MTOAF). Despite a steady decline in Consumer Confidence, growth in Sales Tax collections remained positive thanks in large part to strong auto sales and a robust housing market. (see Figures 8 and 9) National auto sales grew by 5.6 percent in 2002, helped by aggressive dealer incentives and low interest rates. In addition, low mortgage rates led to a surge in home refinancing, lowering payments and freeing cash to be used for other household needs such as home improvements. Many households also used refinancing as an opportunity to extract equity from their homes, further spurring consumer spending. The above factors, combined with the non-recurring revenue proposals described earlier, help to offset overall declines in New York State employment and wages in 2002, which negatively impact growth in Sales Tax collections. In SFY 2003-04, the Committee Staff forecasts Sales Tax revenues, including the impact of the Executive Article VII proposal, will total $9.4 billion, an increase of $609 million, or 6.9 percent from SFY 2002-03. General Fund collections are expected to total $6.752 billion, an increase of $440 million, or 7.0 percent from SFY 2002-03. Sales Tax collections dedicated to LGAC are expected to total $2.251 billion, while dedications to the MTOAF are forecasted at $397 million. The Committee Staff forecast is $13 million below the Executive on an All Funds basis. The forecast for total collections includes an estimated $523 million resulting from the Executive's Article VII proposal that would repeal the current Sales Tax exemption on articles of clothing and shoes under $110. In lieu of the current exemption, the Executive is proposing four one-week Sales Tax Holiday periods each year and would raise the dollar limit on the price of an exempt item from $110 to $500. This proposal would reduce revenues by $160 million in SFY 2003-04. After adjusting for the impact of the Article VII legislation, however, growth in the Sales Tax is only 2.7 percent. The increase in Sales Tax collections is based, in part, on the expectation that two years of declines in New York employment will reverse in SFY 2003-04, growing by 0.8 percent. Growth in personal income, another factor in forecasting Sales Tax revenues, is expected to accelerate next year and is forecasted to grow by 3.9 percent. Consumer Confidence is now becoming a risk to the forecast, and has now declined to its lowest level since October of 1993. While there appears to be a weak correlation, at best, between the Consumer Confidence Index and consumer spending patterns, should declining consumer sentiment translate into a slowdown in spending growth, Sales Tax collections will be negatively affected. Motor Fuel Taxes The Committee Staff estimates that Motor Fuel taxes will total $537 million in SFY 2002-03, an increase of 9.7 percent. The Committee Staff estimate is $2 million higher than the Executive on an All Funds basis. Revenues collected from Motor Fuel Taxes are not deposited into the General Fund, but instead are statutorily dedicated in the following manner:

The Committee Staff forecast for Motor Fuel Taxes in SFY 2003-04 is $533 million, a 0.7 percent decrease. The decline is largely due to a forecast of increased fuel prices in the coming year, which will tend to reduce fuel consumption. The Committee forecast for Motor Fuel Tax collections is $4 million lower than the Executive. Motor Fuel Taxes will be distributed as follows:

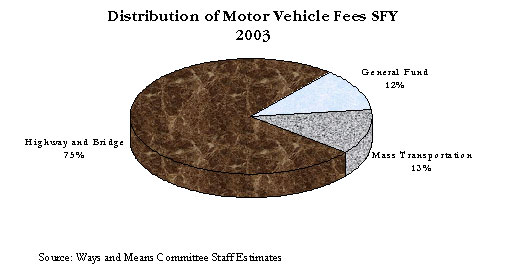

Motor Vehicle Fees The Committee Staff estimates that total collections from Motor Vehicle Fees will total $614 million, an increase of 5.2 percent from SFY 2001-02. This estimate is $5 million lower than the Executive. Of this amount, $463 million is dedicated to the Dedicated Highway and Bridge Trust Fund, which is classified as a Capital Projects fund. Another $77 million is dedicated to the Dedicated Mass Transportation Trust fund and the remaining $74 million will be deposited to the General Fund. The General Fund estimate represents a decline of $111 million, or 60 percent from SFY 2001-02. Most of this decline is attributable to legislation enacted in 2000 and 2001 that increased the dedication of Motor Vehicle Fees by $169 million in SFY 2002-03 to support the Dedicated Highway and Bridge Trust Fund. In SFY 2003-04 Motor Vehicle Fees are forecasted at $653 million, an increase of 6.4 percent from SFY 2002-03. Motor Vehicle Fees deposited to the General Fund are expected to decrease to $72 million, a decrease of $2 million, or 2.7 percent. General Fund Receipts are expected to decline despite Executive proposals to raise fees on title applications, license plates and boat registrations due to a commensurate increase in the level of fee dedications enacted in prior years that are effective in the upcoming fiscal year. Deposits to the Dedicated Highway and Bridge Trust Fund are expected to increase to $485 million, while dedications to the Dedicated Mass Transportation Trust Fund are expected to total $96 million. Cigarette and Tobacco Taxes Over the past couple of years, the excise tax on cigarettes has been increased several times. Beginning in 1999 with the enactment of the Health Care Reform Act (HCRA) of 2000, the tax rate on cigarettes in New York State has risen from 56 cents per pack in 1999 to today's rate of $1.50 per pack of twenty cigarettes. Currently, New York is tied with New Jersey as having the second highest cigarette excise tax rate in the country. Only the state of Massachusetts is higher at $1.51 per pack. All together, New York now collects over $1 billion annually from taxes on cigarettes. In addition to the State's tax rate increase, New York City also increased their excise tax rate on cigarettes from eight cents to $1.50 per pack effective July 2, 2002. This tax is in addition to the State's $1.50 rate and the Federal rate of 39 cents per pack. Cigarettes sold in New York City are typically over $7 per pack. These increases in the cigarette excise tax have had an adverse impact on the number of taxable packs sold in New York State. Figure 10 illustrates the impact that the State and City excise tax rate increases have had on consumption in New York City and the rest of the State. As shown above, there has been steep declines in the number of tax stamps sold to stamping agents immediately after the tax rate increases of March 1, 2000 and April 3, 2002.5 The rate increase from 56 cents to $1.11 in March 2000 resulted in a 60 percent decline in the number of tax stamps sold statewide on a month-to-month basis. The second rate increase from $1.11 to $1.50 per pack that occurred in April 2003 resulted in a statewide decline of 63.7 percent. On July 2, 2002, New York City's tax rate increase took effect. The number of tax stamps sold in New York City declined by 60.6 percent on a month-to-month basis while the rest of the State experienced a 10.1 percent increase. The increase in the rest of the State may be the result of New York City residents shifting their purchases to areas of the State outside of New York City. Figure 10 illustrates that cigarette consumption, as shown by stamp sales, has fallen dramatically in the month following the imposition of a cigarette tax increase. Yet consumption tends to bounce back somewhat, though usually remaining below previous levels. Part of the explanation for this may be the "pre-buying" effect that occurs shortly before a tax rate increase goes into effect. Pre-buying occurs when consumers, in order to avoid paying the additional tax, increase their purchases of cigarettes right before the tax increase goes into effect. Shortly after the tax increase, however, consumption tends to increase as consumers run out of their pre-bought supply and are forced to pay the increased tax when purchasing additional cigarettes, although some may still look for other ways to avoid paying the tax. Sales of Cigarette Stamps in New York City just before the effective date of their tax increase provide a good illustration of the pre-buying effect. In June of 2002, there were 39.6 million tax stamps sold in New York City, an amount that was 54 percent higher than the previous month and 34 percent higher than June 2001. The following month, sales of tax stamps in New York City dropped to 15.6 million, a decline of 60 percent from the previous month and 46 percent below the July 2001 level. In August, there was a slight rebound in New York City consumption, though consumption continue to be about 40 to 50 percent below pre-tax increase levels. Despite the apparent decline in taxable cigarette consumption, the rate increases have yielded additional revenue for the State's coffers. Figure 11 illustrates the impact of the tax rate increases on the revenue generated by the sale of stamps to stamping agents. The Committee Staff estimates that General Fund Cigarette and Tobacco Tax receipts in SFY 2002-03 will total $460 million, a decline of 13.5 percent over SFY 2001-02. General Fund Cigarette Tax receipts represents $417 million of this total. In SFY 2003-04, the Committee Staff forecasts revenue of $446 million for General Fund Cigarette and Tobacco Taxes, which represents a 3.1 percent decrease from SFY 2002-03. General Fund Cigarette Tax receipts represents $401 million of this total in SFY 2003-04.

5 Stamping agents consist of producers, wholesalers or other agents. After the cigarette packs are stamped, the agents sell the stamped packs to retailers and other wholesalers, which are then purchased by the consumer thereby reflecting consumption. |

|

Health Care Reform Act (HCRA) Over 60 percent of State Cigarette Tax collections are statutorily dedicated to the Tobacco Control and Insurance Initiatives Pool, which was created pursuant to the Health Care Reform Act of 2000. Although the revenues dedicated to the Tobacco Control and Insurance Initiatives Pool are used to support a variety of State health care initiatives, they are considered "off-budget" and, therefore, are not included in the reporting of the State's All Governmental Funds Budget. The Committee estimates that $697 million in Cigarette Tax collections will be dedicated to the pool in SFY 2002-03, with $636 million dedicated in SFY 2003-04. The following table details the distribution of Cigarette Tax Collections over the past three years. Cigarette Tax Enforcement In an effort to protect Cigarette Tax receipts from further erosion, the Legislature has passed several measures to counter bootlegging and other forms of cigarette tax evasion. One such measure was enacted under Chapter 262 of the Laws of 2000, which effectively prevented the sale of cigarettes over the Internet to New York residents. This legislation was ruled unconstitutional by the U.S. District Court of the Southern District of New York and it was enjoined from going into effect. New York State appealed this ruling and the 2nd U.S. Circuit Court of Appeals recently overturned it. The Appeals Court concluded that this legislation did not discriminate against interstate commerce and New York consumers' access to cigarettes. The direct fiscal impact of this ruling is yet to be determined, though a recent study estimated that in 2002 New York lost over $895 million due to various forms of cigarette tax evasion.6 An argument can be made that those who are looking to evade State and local excise taxes on cigarettes would just find other means of evasion. On the other hand the court decision may produce additional revenue for the State since at least some Internet consumers will be forced to buy the product from traditional retailers markets. Whatever the outcome, it is clear that cigarette tax evasion will continue to be a major concern for New York State.

6 "New Cigarette Tax Revenue Sources for New York State", Ridgewood Economic Associates, Ltd., prepared for the FACT Alliance, December 24, 2002. |

|

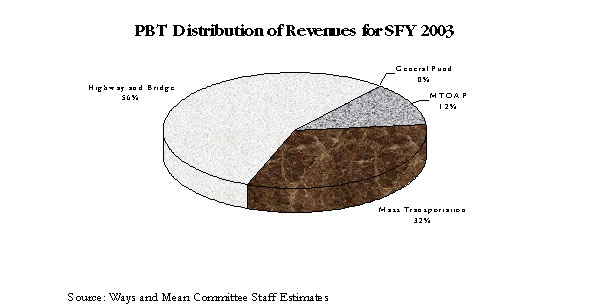

Business Taxes Continue to Erode SFY 2002-03 Business Tax collections have declined by $229 million, or 5.9 percent, through January 2003. Virtually all components of the Business Tax category have declined sharply so far this fiscal year, with the exception of the Insurance Tax and the Petroleum Business Tax, which have increased by 11.4 percent and 7.3 percent respectively. The Committee Staff estimates that Business Tax receipts will total $4.990 billion in SFY 2002-03, representing a decline of $195 million, or 3.8 percent, over SFY 2001-02. This estimate is $46 million lower than that of the Executive. In 2002, corporate profits are estimated to have declined by 1.5 percent, leading to the expected decline of 3.8 percent in Business Tax collections in SFY 2002-03. This estimated decline also includes approximately $285 million in incremental tax cuts including the continued phase-in of recent reductions in the general rate imposed on Entire Net Income (ENI), Utility Tax Reform, and the expansion of the Empire Zones Program. Collections from the current Tax Amnesty program and an increase in the required corporate prepayment in March will somewhat mitigate the overall decline in Business Tax receipts. Taxpayers with business activity in the Metropolitan Commuter Transportation District (MCTD), which includes the City of New York, and seven surrounding counties (Dutchess, Orange, Putnam, Rockland, Westchester, Nassau and Suffolk), are required to pay a 17 percent Regional Business Tax Surcharge. Collections from the surcharge are deposited into the Mass Transportation Operating Assistance Fund (MTOAF). These provisions do not apply to the Petroleum Business Tax. In addition, 80 percent of Utility Tax receipts resulting from the franchise tax on transportation and transmission corporations and associations are deposited into MTOAF, and all collections resulting from the imposition of the Petroleum Business Tax are dedicated either to the Highway Bridge and Trust Fund or MTOAF. The Executive proposes to dedicate 20 percent of the collections from the franchise tax on transportation and transmission corporations and associations to the Dedicated Highway and Bridge Trust Fund beginning April 1, 2004. Dedicated Business Tax receipts are estimated to total $1.602 billion in SFY 2002-03, while the remaining $3.388 billion will remain in the General Fund. SFY 2003-04 The Committee Staff forecast for Business Tax receipts is $5.365 billion in SFY 2003-04, an increase of $375 million, or 7.5 percent, over SFY 2002-03. This forecast is $129 million higher than that of the Executive. This increase is based on an expected increase in corporate profits of 10.0 percent in 2003, and includes approximately $249 million in incremental tax cuts resulting from the expansion of the Empire Zones Program and the continued phase-in of Business Tax incentives including Utility Tax Reform. Part of the expected growth in Business Tax receipts will result from an estimated $158 million increase in tax liability for insurance companies due to the Executive's proposed restructuring of the Insurance Tax. Corporate Franchise Tax Corporate Franchise Tax collections have significantly declined over the past couple of years from the receipts levels of the 1990s. In SFY 2000-01, Corporate Franchise Tax receipts totaled more than $2.6 billion, and generated only about $1.7 billion just one year later. (see Figure 12). Corporate Franchise Tax collections have declined by $122 million, or 9.7 percent, through January 2003. The Committee Staff estimates that Corporate Franchise Tax receipts will total $1.674 billion in SFY 2002-03, representing a decline of $29 million, or 1.7 percent over SFY 2001-02. This estimate is $10 million lower than that of the Executive. Much of this decline is due to continued weakness in the overall economy and, more specifically, in corporate profits. However, the estimate also reflects incremental tax cuts, including about $95 million from the most recent phase of general rate reduction that became applicable to fiscal years beginning on and after July 1, 2001. Because the fiscal year for most businesses coincides with the calendar year, much of the reduction from the last phase of the rate reduction fell in SFY 2002-03. It is estimated that the rate reduction lowered Corporate Franchise Tax collections by a total of $260 million in the current fiscal year. Additionally, the 30 percent bonus depreciation write-off provided to businesses as a part of the Federal Job Creation and Worker Assistance Act of 2002 will reduce Corporate Franchise collections by an estimated $105 million in SFY 2002-03. Tax Amnesty collections and the additional prepayment requirement will partially offset this decline, generating about $72 million under the Corporate Franchise Tax for the fiscal year. Utility Tax Chapter 63 of the Laws of 2000 contained provisions that restructured the Utility Tax by changing the method of taxation for certain utility companies from a gross receipts base to a net income base. Under these provisions, certain portions of the gross receipts tax were eliminated, while others are still being phased-down through 2005. As a result, many of the businesses now pay under the Corporate Franchise Tax reducing the Utility Tax significantly. Utility Tax receipts have declined by $150 million, or 16.4 percent, through January 2003. The Committee Staff estimates that Utility Tax receipts will total $1.050 billion in SFY 2002-03, representing a decline of $168 million, or 13.8 percent, over SFY 2001-02. This estimate includes incremental tax reductions of approximately $93 million from the continued phase-in of Utility Tax Reform, which effectively reduces the rates applicable to different portions of the tax. This estimate is $13 million lower than that of the Executive. Utility Tax receipts are forecast to total $1.086 billion in SFY 2003-04, representing an increase of $36 million, or 3.4 percent, over SFY 2002-03. The forecast includes the continued phase-in of Utility Tax Reform, reducing revenues by an estimated $114 million in SFY 2003-04. This forecast is $93 million higher than that of the Executive. Insurance Tax Insurance Tax collections have increased by $54 million, or 11.4 percent, through January 2003. The Committee Staff estimates that Insurance Tax receipts will total $741 million in SFY 2002-03, representing an increase of $45 million, or 6.4 percent over SFY 2001-02. This estimate is $4 million higher than that of the Executive. This estimate includes incremental tax cuts resulting from reductions in both the tax rate and the tax cap based on premiums written, totaling approximately $15 million for the fiscal year. The Executive proposes to restructure the Insurance Tax to one based mainly on premiums, resulting in a net increase in tax liability for insurance companies of $158 million in SFY 2003-04. (see page 114) The Executive also proposes to create a new Certified Capital Company (CAPCO) Program authorizing tax credits of $125 million in total for insurance companies that invest in CAPCOs. These insurance companies would receive tax credits equal to 50 percent of their investment, up to $10 million per investor. These credits would be available beginning in 2005, and would be spread out over a ten-year period. The CAPCO proposal requires that investments be made in companies that have a minimum relationship with a research center that has received financial support from the State through the Centers of Excellence Program, the Gen*NY*sis Program, the Centers for Advanced Technology Program, or the Capital Facilities Program. Investments in a high technology or biotechnology project authorized by the RESTORE New York program would also qualify. Program eligibility would also be expanded to certain subsidiaries of the New York State Urban Development Corporation (UDC). Insurance Tax receipts are forecast to total $917 million in SFY 2003-04, representing an increase of $176 million, or 23.8 percent over SFY 2002-03. This forecast reflects $158 million in increased tax liability for insurance companies resulting from the Executive proposal to restructure the Insurance Tax. This forecast is $14 million higher than that of the Executive. Bank Tax Bank Tax collections have declined by $70 million, or 16.6 percent, through January 2003. The Committee Staff estimates that Bank Tax receipts will total $496 million in SFY 2002-03, representing a decline of $70 million, or 12.3 percent over SFY 2001-02. This estimate reflects continued weakness in corporate profits, coupled with incremental tax cuts of approximately $30 million resulting from recent reductions in the Bank Tax rate. This estimate is $22 million lower than that of the Executive. In SFY 2003-04, Bank Tax collections are forecast to total $514 million, representing an increase of $18 million or, 3.6 percent over SFY 2002-03. This forecast reflects somewhat of a turnaround in corporate profits, and includes an estimated $25 million in incremental tax reductions resulting from the final phase of the Bank Tax rate reduction. This forecast is $29 million lower than that of the Executive. Petroleum Business Tax The Committee Staff anticipates receipts of $1.029 billion for Fiscal Year 2002-03, representing a 2.6 percent growth over Fiscal Year 2001-02. Revenues from this tax are divided between various dedicated funds. Of the total expected in SFY 2002-03, $334 million will be deposited in the Dedicated Mass Transportation Trust Fund, and $126 million will be deposited into the Mass Transportation Operating Assistance Fund. The remaining $569 million is deposited into the Dedicated Highway and Bridge Trust Fund. In State Fiscal Year 2003-04, total Petroleum Business Tax collections are estimated to total $1.041 billion, a 1.2 percent increase from SFY 2002-03. This forecast is $40 million higher than the Executive. Of the total expected in SFY 2003-04, $338 million will be deposited in the Dedicated Mass Transportation Trust Fund, and $128 million will be deposited into the Mass Transportation Operating Assistance Fund. The remaining $575 million is deposited into the Dedicated Highway and Bridge Trust Fund. Petroleum Business Tax receipts are based on the volume of fuel imported or produced, refined, manufactured or compounded in the state. On January 1st of each year, the tax rates are indexed based on the producer price index for refined petroleum products published by the Bureau of Labor Statistics. Annual changes in Petroleum Business Tax rates are statutorily limited to plus or minus five-percent. In 2002, Petroleum Business Tax rates were lowered by 5 percent. The Committee Staff expects tax rates to increase by the maximum of 5 percent in 2003. Other Taxes Other Tax collections are expected to total $1.212 billion in SFY 2002-03, representing an increase of $39 million, or 3.3 percent over SFY 2001-02. This estimate is $4 million lower than that of the Executive. In SFY 2003-04, Other Tax receipts are forecast to total $1.191 million, a decrease of $21 million, or 2.9 percent. Other Taxes include the Estate Tax, Real Estate Transfer Tax, Pari-Mutuel, and the Real Property Gains Tax (repealed in 1996). Estate Tax The Committee Staff estimates that SFY 2002-03 receipts will total $722 million, a decrease of 6.0 percent. Collections year-to-date are down 4.9 percent over the same period a year ago, after showing strong signs earlier in the year. The estimate assumes Gift Tax receipts of $5 million and $4 million resulting from the Tax Amnesty Program. Congressional action to gradually phase-out the Estate Tax increased the State threshold for taxable estates to $1 million for 2002, and is estimated to have lowered receipts by $31 million in SFY 2002-03. The Committee Staff estimate is $4 million below that of the Executive. The Committee Staff forecast for SFY 2003-04 is $732 million, which represents an increase of 1.4 percent in overall Estate Tax receipts. The increase reflects a forecasted rebound in equities prices, which are correlated with increases in the value of taxable estates. This forecast is $4 million below the Executive. Real Estate Transfer Tax Real Estate Transfer Taxes are dedicated to the Environmental Protection Fund (EPF) and to pay debt service on the Clean Water/Clean Air Bond Act (CW/CA). Each year $112 million is statutorily dedicated to the EPF, while the remainder is dedicated to CW/CA. Revenues that are not needed to pay debt service on the CW/CA Bond Act are transferred back to the General Fund. See page 37-38 for a description on Transfers to the General Fund. The Committee Staff estimate for total Real Estate Transfer Tax collections in SFY 2002-03 is $455 million, representing growth of 22.8 percent over the prior fiscal year. Of the total, $112 million is statutorily dedicated to the EPF, and the remaining $343 million is dedicated for debt service on the CW/CA. Despite the slump in the commercial real estate market in New York City, Real Estate Transfer Tax collections have been boosted by continuing strength in the residential real estate market. In SFY 2003-04, expectations of a softening real estate market will lead to a significant decline in Real Estate Transfer Tax collections. The Committee forecast is $420 million, a decline of 7.7 percent. Of the total, $112 million will be dedicated to the EPF and the remaining $308 million will be dedicated to pay CW/CA debt service. |

|

The General Fund is used to pay for most of the State's operations and local assistance. General Fund Receipts include all tax collections and Miscellaneous Receipts not dedicated to other funds, as well as transfers from other funds. The Committee Staff also estimates Lottery receipts since proceeds from the Lottery are dedicated to fund education. SFY 2002-03 The Committee Staff estimates that General Fund Receipts and Lottery will total $41.313 billion in SFY 2002-03, a decline of $1.392 billion, or 3.3 percent, over SFY 2001-02. This estimate is $254 million below the Executive's estimate. The decline in General Fund Receipts and Lottery is somewhat offset by approximately $2.8 billion in one-shot revenue actions included in the Enacted Budget, including $339 million in non-recurring tax actions, $542 million in non-recurring Miscellaneous Receipts, and $680 million in one-time fund sweeps and transfers. In addition, the Executive Budget proposal includes $1.9 billion in Tobacco Securitization proceeds to boost General Fund Receipts in the current fiscal year. Tax collections earmarked for the General Fund are estimated to total $28.157 billion in SFY 2002-03, representing a decline of 24.7 percent over SFY 2001-02. However, most of this decline reflects an accounting change in the Comptroller's reporting of Personal Income Tax collections (see below box). After adjusting for this change and other adjustments (see Table 18), General Fund Tax collections are estimated to total $33.800 billion, a decline of $3.291 billion, or 8.9 percent, from SFY 2001-02. This decline is due to the impact of the recession on receipts, including a sharp drop in total Personal Income Tax and Business Tax collections from the prior fiscal year. Through January 2003, General Fund Tax collections have declined by $3.297 billion, or 10.3 percent from the same period in SFY 2001-02. Collections for the remainder of the fiscal year are expected to remain flat due to an expected increase in receipts from non-recurring tax actions such as the State Tax Amnesty Program and increased business tax prepayments that are due in March.

|

|

|

|

|

The Committee forecast for General Fund Receipts and Lottery is $40.262 billion in SFY 2003-04, representing a decline of $1.051 billion or 2.5 percent from SFY 2002-03. Despite an increase of 4.3 percent in General Fund Tax collections, non-recurring revenue actions that boosted revenues in SFY 2002-03 will not take place to the same degree in SFY 2003-04, contributing to the anticipated a net decline in receipts. The Committee Staff forecast includes approximately $1 billion in proposed tax and fee increases by the Executive, offset by of $518 million in incremental tax reductions enacted in prior years. This forecast is $188 million higher than that of the Executive. Over a two-year period, the Committee Staff estimates are $66 million below the Executive's. The Committee Staff forecast for General Fund Tax collections is $27.365 billion in SFY 2003-04, a decline of $792 million, or 2.8 percent, from SFY 2002-03. This decline reflects dedications of the Personal Income Tax to the Revenue Bond Tax Fund over and above those in SFY 2002-03. Adjusting once again for accounting changes detailed in Table 18, General Fund Tax collections are forecasted to total $35.241 billion, an increase of $1.441 billion, or 4.3 percent, from SFY 2002-03. Transfers From Other Funds to the General Fund In SFY 2002-03, more than 30 percent of all tax revenues are dedicated to Special Revenue, Debt Service or Capital Project Funds. However, the impact on General Fund spending is noticeably smaller as a result of transfers back to the General Fund of tax collections that are in excess of debt service, or other programmatic requirements. The Committee Staff estimates that transfers back to the General Fund will total $7.268 billion in SFY 2002-03. For SFY 2003-04, the Committee Staff forecasts total transfers to the General Fund will total $7.487 billion, an increase of 3.0 percent over SFY 2002-03. The increase is due to a rebound in growth in the Sales Tax, and includes the net impact from the Executive's proposed repeal of the current clothing tax exemption and the establishment of four new Sales Tax-free weeks. While there are dozens of funds that transfer excess funds back to the General Fund, the majority of such transfers are from transfers in excess of debt service: 1) The Revenue Bond Tax Fund; 2) Transfers in Excess of Local Government Assistance Corporation requirements, and 3) Real Estate Transfer Tax revenues in excess of Clean Water/Clean Air Bond Act debt service requirements. Revenue Bond Tax Fund (RBTF) Chapter 383 of the Laws of 2001 created the Revenue Bond Tax Fund (RBTF), which is used for debt service. As of May 2002, 25 percent of monthly Personal Income Tax receipts are deposited into the RBTF. Receipts not required to pay debt service on Revenue Bonds are ultimately transferred back to the General Fund. In SFY 2002-03, the Committee Staff estimates that $4.226 billion will initially be dedicated to the RBTF. Of that amount, only $28 million is required for debt service and the remaining $4.198 billion will be transferred back to the General Fund. In SFY 2003-04, the Committee Staff estimates that $5.128 billion in Personal Income Tax collections will initially be transferred to the Revenue Bond Tax Fund. Of that amount, $233 million will be required for debt service and the remaining $4.895 billion will be transferred back to the General Fund. Local Government Assistance Tax Fund (LGATF) The Local Government Assistance Corporation (LGAC) was created in 1990 to help the State eliminate the need for spring borrowing. One-fourth of the sales and use tax collections are dedicated to LGATF to pay debt service on the bonds issued by LGAC. In SFY 2002-03, LGATF is expected to receive $2.104 billion. Of this amount, $248 million is used for debt service, while $1.856 billion in transferred back to the General Fund. In SFY 2003-04, the Committee Staff estimates that $2.251 billion will be dedicated to the LGTAF, with $255 million used for debt service and the remaining $1.995 billion transferred back to the General Fund. Real Estate Transfer Tax (RETT) Real Estate Transfer Taxes are dedicated to the Environmental Protection Fund (EPF) and to debt service on the Clean Water/Clean Air Bond Act (CW/CA). Each year $112 million is statutorily dedicated to the EPF, while the remainder is dedicated to CW/CA. Revenues that are not needed to pay debt service on the CW/CA Bond Act are transferred back to the General Fund. The Committee Staff estimates that $272 million in excess Real Estate Transfer Tax revenues will be transferred back to the General Fund in SFY 2002-03. An additional $218 million will be transferred back to the General Fund in SFY 2003-04. Most of the decline can be explained by an expected decline in overall Real Estate Transfer Tax collections in the upcoming fiscal year. Other Transfers On a separate note, Chapter 383 of the Laws of 2001 permitted the Executive to negotiate a tribal-state compact with the Seneca Indian Nation to operate casinos in Niagara Falls, Buffalo and a potential third site. The authorization is contingent upon a memorandum of understanding between the Executive and the Nation, which requires the Nation to remit to the State 18 percent of the proceeds from slot machines in the first four years of operation, and a larger share thereafter. On December 31, 2002, the Seneca Niagara Casino opened its doors to the public. Under the terms of the tribal-state compact negotiated between the Executive and the Seneca Indian Nation, however, the State will not receive any of its share of the proceeds until December 31, 2003. Miscellaneous Receipts Miscellaneous Receipts consist of a wide variety of non-tax receipts that are dedicated to the General Fund. There are currently six categories of collections that encompass General Fund Miscellaneous Receipts: Abandoned Property, Federal Grants, General Fund Refunds and Reimbursements, Investment Income, Licenses and Fees, and Other Transactions. Other Transactions has become the catchall category for non-recurring revenue transactions (aside from those that can be categorized elsewhere). Though not covered in this report, the State Funds budget also includes approximately $10 billion in Miscellaneous Special Revenue Funds, including fees and agency offsets, that are used to support State Agency appropriations. The Executive is proposing to use $1.9 billion in Tobacco Securitization Bonds to help close the SFY 2002-03 budget gap. This action raises total Miscellaneous Receipts to $4.085 billion, an increase of $2.6 billion from SFY 2001-02 and $1.937 billion above the Enacted Plan. Absent this action, total Miscellaneous Receipts are expected to total $2.185 billion, or $37 million higher than the Enacted Plan. Aside from the addition of Tobacco Bond receipts, some of the main items in the Other Transactions category include:

The Committee Staff estimate is the same as that of the Executive. The Committee Staff forecast for SFY 2003-04 is also the same as the Executive's. The proposed law forecast is $3.538 billion, a decrease of $505 million from the proposed law forecast in SFY 2002-03. The decline represents the absence of several non-recurring revenue actions contained in the SFY 2002-03 Enacted Plan that are not expected to recur in the upcoming fiscal year. Excluding the Tobacco Proposal, Miscellaneous Receipts are expected to total $1.680 billion, a decline of $505 million from the current law in SFY 2002-03. Article VII proposals in the Executive Budget Securitization of Tobacco Settlement Payments The Executive has proposed Article VII legislation that would authorize the State to securitize revenues from the 1998 Master Settlement Agreement, which is an agreement between tobacco companies and 46 States, the District of Columbia and five U.S. territories. The remaining four states (Florida, Minnesota, Mississippi and Texas) have settled in earlier agreements. Under this legislation, a portion of the State's share of revenues from the tobacco companies will be secured through the issuance of bonds from the Tobacco Settlement Financing Corporation, a proposed new subsidiary of the Municipal Bond Bank Agency. The Corporation would be authorized to issue bonds to reimburse the State's General Fund for any of the following purposes: any capital purpose or programs; payment of debt service for any of the State's obligations; grants to local governments, school districts or public benefit corporations; or as a revenue source for other State expenditures. If the Executive proposal were to be adopted, General Fund Miscellaneous Receipts would receive Tobacco Bond receipts of $1.9 billion in SFY 2002-03 and $1.9 billion in SFY 2003-04. In addition to the Tobacco Securitization proposal, the Executive is proposing a series of fee increases and one-time revenue actions to close the expected SFY 2003-04 budget gap. The total amount attributable to fee increases, additional fines, abandoned property and indirect costs are expected to total $178 million. Other transactions include a contribution from the Power Authority for the Power for Jobs program of $58 million. PASNY will be contributing $125 million over a two-year period, which is the statutory limit on contributions for this program from PASNY. Other transactions also include Bond Issuance Charges of $71 million, and Wireless Surcharge collections of $62.7 million. According to the review of the SFY 2003-04 Executive Budget issued by the State Comptroller, the Executive used a total of nearly $6 billion in enacted and proposed non-recurring revenue actions in order to balance the budget in SFY 2002-03. Of that total, approximately $4 billion would provide General Fund relief, while the remaining savings accrue to other funds. Of the General Fund amounts, $2.4 billion would come in the form of Miscellaneous Receipts, including $1.9 billion in Tobacco Securitization receipts. In addition, $338 million in one-time revenues will be received from tax actions taken in the Enacted Budget, $1.25 billion in Refund Reserve transactions and $680 million in transfers from other funds. In SFY 2002-03, the Executive is proposing to generate an additional $3.3 billion in non-recurring revenues, including another $1.9 billion in Tobacco Securitization proceeds. The following table lists the items that were enacted in SFY 2002-03 and those proposed for SFY 2003-04. Source: Ways and Means and the Office of the State Comptroller.Lottery The Committee Staff expects SFY 2002-03 revenues to total $1.803 billion, which falls short of the current Lottery Aid Guarantee of $1.843 billion by $40 million, and represents growth of 15.5 percent. This estimate is $26 million lower than that of the Executive. Lottery receipts have increased by $137 million, or 12.2 percent, through January 2003. Most of this increase is due to the introduction of a new multi-state lottery game, Mega Millions, for which sales began May 15, 2002. Excluding Mega Millions, lottery revenues would have increased by only 2.8 percent through January 2003. Instant Game sales have also been strong, growing by 27.0 percent year-to-date. Some of this increase is the result of recently enacted legislation allowing for a 75 percent prize payout for up to three Instant Games each year. Legislation enacted in 2001 authorizes the Lottery Division to license the operation of video lottery gaming at Aqueduct, Monticello, Yonkers, Finger Lakes and Vernon Downs. Certain other racetracks may also be licensed pursuant to local law. In the 2002 Legislative Session several enhancements were made to address concerns raised by some of the racetracks. These enhancements included an extension of the original sunset provisions, provisions for the subordination of debt for the New York Racing Association (NYRA), a conditional extension of the NYRA franchise, and temporary authorization for racetracks to negotiate with horsemen's organizations regarding the shares to be allocated to purses. In SFY 2003-04, Lottery receipts are expected to total $1.830 billion, an increase of $27 million, or 1.5 percent, over SFY 2002-03. This forecast is $5 million lower than that of the Executive. The Executive submitted Article VII legislation with the SFY 2003-04 Executive Budget to address some additional concerns raised by the tracks regarding their percentage of the revenues, hours of operation, and the ability to obtain financing to construct the facilities that will house the Video Lottery Terminals (VLTs). The Executive proposal would extend the hours of operation and make them more flexible by allowing facilities to run for a maximum of 126 hours per week, an average of 18 hours per day. The proposal would also remove the current sunset and reduce the amount that the tracks would be required to enhance purses and share with the horsemen. Although the Executive proposal attempts to address some of the basic concerns raised by the tracks, there has been no confirmation that the tracks would accept the proposal as currently drafted and begin the operation of VLTs if the legislation were enacted. Additionally, although the Executive included $61 million in last year's financial plan for the operation of VLTs, there is no revenue included in this year's financial plan even though the Request for Proposals (RFP) process is essentially completed and the justification for this proposed legislation is that tracks would begin operating VLTs. |

|

Taxes not deposited into the General Fund but dedicated for other purposes have tripled since SFY 1994-95. As the following chart illustrates, the portion of State tax collections that was dedicated to funds other than the General Fund was roughly 10 percent in SFY 1994-95. That share has now increased to approximately 34 percent in SFY 2003-04. The actual size of the dedication, however, is somewhat misleading. Approximately 57.5 percent of all dedicated taxes flow back to the General Fund in the form of transfers. After adjusting for transfers back to the General Fund, the share of All Funds Taxes that end up in the General Fund Receipts is approximately 84 percent. The rationale for these accounting maneuvers is to allow a larger share of revenue flow through the State Debt Service and Capital Project Funds in order to meet the required coverage ratios mandated by agreed to bond covenants. By dedicating a tax revenue stream, the State is also able to provide an increased level of comfort to creditors, thereby lowering the interest rates the State pays on debt issuances. Figure 14 summarizes, by State Fund, the total amount of State taxes that are dedicated for special purposes. Beyond the scope of this report, however, is the growing level of dedicated fees and other Miscellaneous Receipts, which show up as Special Revenue Funds, that support total State spending. In SFY 2002-03, dedicated fees and other Miscellaneous Receipts will total over $12 billion, and account for nearly 22 percent of the State Funds Budget (excluding Federal Funds). This percentage will increase to 23.4 percent of the State Funds Budget in SFY 2003-04 should the Legislature adopt the proposed Executive Budget. The following sections will describe the major funds that receive the bulk of non-General Fund Tax receipts. STAR Fund The STAR Fund was created to receive funds from the Personal Income Tax that were set aside to pay for the cost of the State's School Tax Relief program (STAR). The money deposited into this fund is used to reimburse school districts for revenues foregone due to the STAR Basic and Enhanced Real Property Tax exemptions. The amount of revenue dedicated to pay for the cost of the STAR program in SFY 2003-03 is expected to total $2.667 billion. In SFY 2003-04, the cost of the STAR program, including $93 million in savings from the Executive's Article VII proposal, is expected to total $2.707 billion, an increase of 1.5 percent. Mass Transit Operating Assistance Fund The Mass Transit Operating Assistance Fund (MTOAF) was created by the Legislature in SFY 1981-82 to help finance State mass transportation operating systems, which at that time were experiencing operating deficits. Pursuant to §88-a of the State Finance Law, the fund is subdivided into upstate and downstate dedicated tax fund accounts. The downstate account provides funding for the transit systems in the Metropolitan Transportation Commuter District (MCTD) and consists of revenues from the following taxes: the Petroleum Business Tax (PBT); the MTA Corporate Tax Surcharge; a 0.25 percent Sales Tax imposed in the counties that comprise the MCTD, and surcharges on companies subject to tax under Article 9. A portion of the PBT is also dedicated to the upstate account and is the sole source of dedicated funding for that account. In SFY 2002-03, the Committee Staff estimates that $1.146 billion will be dedicated to support the activities funded through the MTOAF, an increase of 8.6 percent. In SFY 2003-04, the Committee Staff forecasts a total of $1.094 billion will be dedicated from the various taxes to support MTOAF, a decrease of 4.5 percent from SFY 2002-03. Dedicated Mass Transportation Trust Fund The Dedicated Mass Transportation Trust Fund (DMTTF) receives dedicated revenues from the PBT, Motor Fuel Tax, and Motor Vehicle Fees. Dedicated tax revenues deposited into the DMTTF are expected to total $477 million in SFY 2002-03. Fund dedications are expected to total $545 million in SFY 2003-04. Much of this increase is due to legislative increases in the level of statutory dedications to this fund. Revenue Bond Tax Fund (RBTF) Chapter 383 of the Laws of 2001 created the Revenue Bond Tax Fund (RBTF), which is used for debt service. As of May 2002, 25 percent of Personal Income Tax receipts, excluding reserve transactions, are deposited into the RBTF. In SFY 2002-03, it is estimated that $4.226 billion will be dedicated to the RBTF. Of that amount, it is expected that only $28 million is necessary for debt service payments, with the remaining $4.198 billion transferred back to the General Fund. In SFY 2003-04, the Committee forecasts that the RBTF dedication will total $5.128 billion. Of that amount, $233 million will be required for debt service and the remaining $4.895 billion will be transferred back to the General Fund. Local Government Assistance Tax Fund (LGATF) The Local Government Assistance Corporation (LGAC) was created in 1990 to help the State eliminate the need for spring borrowing. One-fourth of the Sales and Use Tax collections are dedicated to LGATF to pay debt service on the bonds issued by LGAC. In 2002-03, LGATF is expected to receive $2.104 billion. Of this amount, $248 million is used for debt service, while $1.856 billion is transferred back to the General Fund. In 2003-04, the Committee Staff estimates that $2.251 billion will be dedicated to the LGTAF, with $255 million used for debt service and the remaining $1.995 billion transferred back to the General Fund. Real Estate Transfer Tax (RETT) Real estate transfer taxes are dedicated completely dedicated to the Environmental Protection Fund (EPF) and to pay debt service on the Clean Water/Clean Air (CW/CA) Bond Act. Each year $112 million is statutorily dedicated to the EPF, while the remainder is dedicated to CW/CA. Revenues not needed to pay debt service on the CW/CA Bond Act are transferred back to the General Fund. The Committee estimates that $272 million in excess Real Estate Transfer Tax revenues will be transferred back to the General Fund in SFY 2002-03 and that $218 million will be transferred back to the General Fund in SFY 2003-04. Most of the decline can be explained by an expected decline in overall Real Estate Transfer Tax collections in the upcoming fiscal year. Dedicated Highway and Bridge Trust Funds (DHBTF) The DHBTF is the largest component of the State's Transportation Capital Program. The fund receives dedicated revenues from the PBT, Motor Fuel Tax, Highway Use Tax, Motor Vehicle Fees, and the Auto Rental Tax. In SFY 2002-03, the fund is expected to receive $1.569 billion in dedicated tax revenues, an increase of 12.6 percent from the prior year. In SFY 2003-04, the fund is expected to receive $1.675 billion, an increase of 6.8 percent over SFY 2002-03. The Committee Staff estimate is $22 million higher than the Executive. A major reason for the increased dedication of former General Fund Tax revenues is that the amount of debt incurred through this fund has required an ever increasing share of revenue to enable the State to maintain coverage ratio on the bonds issued.

TAX INCREASE PROPOSALS The Executive has proposed various tax increases that total approximately $733 million in SFY 2003-04. These proposals include the following

FEE INCREASE PROPOSAL The Executive has also proposed various fee increases that total approximately $734 million. Of this amount, approximately $269 million would remain in the General Fund, and the rest would be dedicated to other funds. REVENUE REDUCTION PROPOSALS The Executive has proposed various tax reduction proposals that will reduce receipts by approximately $238 million when fully implemented. These proposals would:

SCHOOL TAX RELIEF PROGRAM (STAR) In order to realize savings in this fiscal year, the Executive is proposing to freeze School Year 2003-04 Basic STAR benefits at their School-Year 2002-03 levels. This proposal is expected to save the State $93 million in STAR reimbursements in SFY 2003-04. OTHER PROPOSALS The Executive proposes to change the VLT program by increasing the hours of operation, altering the distribution of receipts, and eliminating the current sunset provision.

|

|

|

REVENUE SOURCE |

SFY 2003-04 REVENUE IMPACT |

|

|

||

| Tax Increase Proposals | $733.0 | |

| Eliminate Exemption from Sales Tax on Clothing | 535.0 | |

| Restructure the Insurance Tax | 158.0 | |

| Increase Limited Liability Company Filing Fee | 25.0 | |

| Initiate Withholding for Nonresident Partnership | 15.0 | |

|

|

||

| Fee Increase Proposals | $734.3 | |

|

|

||

| Department of Agriculture and Markets | ||

|

|

New Biennial Fee on Unregistered/Unlicensed Retail Stores, Food Warehouses, Feed Mills |

0.3 |

|

|

New Annual Fee for Certificates of Free Sale | 0.07 |

|

|

Increase Biennial Fees for Slaughterhouses, Refrigerated Warehouses, Food Salvage Facilities | 0.02 |

|

|

Increase Biennial Fees for Nursery Dealers and Growers | 0.3 |

|

|

||

| Division of Alcoholic Beverage Control | ||

|

|

Increase Penal Bonds | 0.5 |

|

|

||

| Division of Budget | ||

|

|

Increase Cost Recovery Assessment's Cap | 15.0 |

|

|

||

| Office of the State Comptroller | ||

|

|

Increase Criminal Fines Deposited Into the Justice Court Fund | 6.3 |

|

|

Reduce Dormancy Period for Uncashed Checks | 38.0 |

|

|

||

| Consumer Protection Board | ||

|

|

Increase the Do Not Call Registry Fee | 0.0 |

|

|

||

| Department of Correctional Services | ||

|

|

Increase Charge for License Plates | 21.7 |

|

|

||

| Crime Victims Board | ||

|

|

Increase Crime Victims Assistance Fee | 0.8 |

|

|

Impose Crime Victims Assistance Fee on V&T Offenses | 4.5 |

|

|

Increase Mandatory Surcharges on Penal Law | 2.0 |

|

|

Increase Mandatory Surcharges on Penal Law Convictions by 25%-50% | 2.0 |

|

|

Increase Mandatory Surcharges on V&T Convictions by 25%-50% | 1.5 |

|

|

||

| Division of Criminal Justice Services | ||

|

|

Increase Mandatory Surcharges | 11.9 |

|

|

Increase Attorney Registration Biennial Fee | 2.0 |

|

|

Impose $35 Surcharge on Driver's License Reinstatement | 9.0 |

|

|

HAZMAT License Criminal Background Check | 2.0 |

|

|

DNA Databank and Sex Offender Registration Fees | 0.8 |

|

|

Raise Fingerprinting Fee | 9.9 |

|

|

Increase Data Processing Fee for Criminal History | 9.5 |

|

|

||

| Education Department | ||

|

|

Cap STAR Savings for Non-Seniors at 2002-03 Levels | 93.0 |

|

|

||