|

Assemblyman Dave McDonough |

||

|

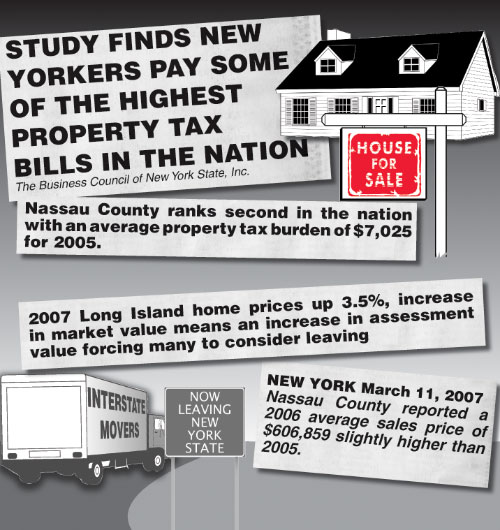

The American Dream of Homeownership Has Become A Nassau County Nightmare | |

|

||||||

|

| The American Dream of Homeownership Has Become A Nassau County Nightmare |

If enacted, the Property Taxpayer Protection Act would limit the property tax burden on homeowners and businesses by providing school district mandate relief, reducing county Medicaid costs, strengthening financial accountability over school tax dollars and promoting local government efficiency.

ASSEMBLYMAN McDONOUGH’S PLAN New York’s per capita property taxes are 57% higher than the national average and school property taxes are a major contributor. The focal point of the Property Taxpayer Protection Act is to combat the school district tax burden of homeowners and businesses by:

Modeled after Massachusetts’ successful “Proposition 2 ½,” the Property Taxpayer Protection Act looks to achieve similar results. While Massachusetts once had the highest property taxes nationwide, the adoption of measures like the property tax cap has lowered their rank to 32nd. More importantly, limiting the growth of property taxes in Massachusetts has not endangered their education system, as they currently have one of the top five educational systems in the nation.

School District Mandate Relief State mandated programs place local taxpayers and governments in the difficult position of paying for services that they have little or no control over. This section of the act would:

|

||||||||||||

Lower Property Taxes by Reducing County Medicaid Costs According to the New York State Association of Counties, Medicaid costs consume the largest portion of county budgets, and in some cases, the cost of providing Medicaid services is greater than the amount of property taxes collected. In addition, Medicaid waste, fraud and abuse cost New York taxpayers billions annually. The Property Taxpayer Protection Act would:

Strengthen Financial Accountability Over School Tax Dollars and Promote Local Government Efficiency New York has some of the best teachers, administrators and schools. However, misuse of school dollars continues. This section of the Property Taxpayer Protection Act supports the strengthening of accountability over school tax dollars by:

Encourage Insurance Pooling The pooling of health insurance spreads the cost for health care across a greater number of participants, and the greater the number of participants, the more stable the average cost per user becomes. Governmental employees’ health care premiums are frequently paid by the employer (taxpayers); by allowing local and county governments to pool health insurance contributions, it will save taxpayers in the long run. The Property Taxpayer Protection Act would:

|

|

Back |